Transamerica Living Benefits (LB)

Term life insurance is one of the most frequently purchased types of life insurance coverage when life insurance protection is needed. Looking to compare life insurance policies? We can help.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

Farmers CSR for 4 Years

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Looking to compare life insurance policies? We can help. Enter your ZIP code to get free quotes from multiple insurers.

A new Type of Term Life Insurance Coverage

Term life insurance is one of the most frequently purchased types of life insurance coverage when life insurance protection is needed.

Out of all the different types of life insurance protection available, term life insurance is the most basic and easiest for consumers to understand.

Term insurance is so basic and so easy to understand some might say it’s a little boring to talk or read about until now!

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Life insurance coverage that pays while you’re living?

Transamerica Life Insurance has introduced an exciting new term life insurance coverage called Trendsetter Living Benefits (LB).

Transamerica Life Insurance Living Benefits (LB) is not just your typical term life insurance coverage.

Transamerica has designed a whole new type of term life insurance that is creating a lot of interest when considering life insurance coverage.

What makes Transamerica Living Benefits (LB) so interesting and unique?

Well to start, Trendsetter LB is a typical term life insurance policy. It offers all the same features of a general term life insurance policy. Trendsetter Living Benefits (LB) has fixed premiums for term lengths of 10, 15, 20, 25 & 30 years.

Transamerica Living Benefits (LB) was created with a feature that gives you the ability to receive cash benefits should you become ill with a chronic, critical or terminal illness during your policy years.

Yes, that’s correct, cash from your life insurance policy with no medical exam life insurance quote while you are living!

How do the Transamerica Living Benefits (LB) work?

If at any time during your term life insurance policy years you are diagnosed with certain chronic, critical or terminal illness, a Transamerica Living Benefits (LB) policy will allow you to accelerate a portion of your policy’s death benefit amount.

Chronic Illness – Allows the insured to receive up to a maximum of 24% of the policy’s death benefit (per year) should the insured be determined by a licensed health care practitioner to be unable to perform two of the six daily living (bathing, continence, dressing, eating, toileting, and transferring) for a period of 90 consecutive days.

The maximum amount that can be received over the lifetime of the insured is 90% of the death benefit amount not to exceed $1,500,000 of the original death benefit. The minimum death benefit amount that can be received is $1,000 annually.

Critical Illness – Allows the insured to receive up to 90% of the death benefit in advance should the insured be determined by a licensed physician to have suffered a critical health condition such as cancer, heart attack, stroke, a major organ transplant, end-stage renal failure, Amyotrophic Lateral Sclerosis (ALS), blindness, or paralysis due to loss of two or more limbs. The maximum amount that can be received is the lesser of 90% of the death benefit amount of the face amount of the policy or $500,000, and the minimum face amount that may be accelerated is $2,500

Terminal Illness – Allows the insured to receive a portion of the policy’s death benefit as a lump sum payment in advance of death when a licensed physician has diagnosed the insured to have less than 12 months to live. The maximum amount that can be received is 100% of the death benefit to a maximum of $1,500,000. The minimum amount is $5,000 of the total death benefit.

Transamerica Living Benefits (LB) VS Traditional term life insurance?

Life is full of surprises and sometimes these surprises can throw an unexpected wrench in your financial plans.

Unexpected illnesses or serious medical conditions can cause major devastation to a family’s life savings.

A traditional term life insurance policy is a great addition to any individual’s financial plan. It can help ensure that your financial plans are met after you are gone.

A Transamerica Living Benefits (LB) policy will not only ensure that your financial plans are met after you are gone, but can provide you an income if you become ill with a chronic, critical or even a terminal illness.

A traditional term life insurance policy cannot offer this.

According to the Centers for Disease Control and Prevention (CDC), it has been shown in recent studies that nearly half of Americans suffer from a chronic health condition such as:

- Heart Attack

- Stroke

- Cancer

- End Stage Renal Failure

- Major Organ Transplant

- ALS

- Blindness From Diabetic Retinopathy

- Paralysis of two or more limbs

Suffering from any one of these chronic illnesses can create devastation to one’s financial savings.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

A Transamerica Living Benefits Policy can Provide Income

- Income for treatment not covered by a health insurance policy

- Income to pay bills

- Income to pay the mortgage

- Income to replace loss of employment wages due to illness

- Income for in-home care

- Income so you do not need to dip into retirement funds

Transamerica Living Benefits term life insurance policy is making big changes to traditional term life insurance.

A Transamerica Living Benefits policy is not just a great way to protect your family’s financial security after you’re gone but a great way to protect your family’s financial savings from an unexpected illness while you are living.

The cost of Transamerica Traditional Term vs. Transamerica Living Benefits (LB)

Male Age 50 Preferred Non-Smoker $250,000

Transamerica Trendsetter Super 10 Year Term = $37.41 monthly

Transamerica Living Benefits LB 10 Year Term = $40.21 monthly

The difference…for an additional $2.80 more a month, a Transamerica Living Benefits policy can not only provide you with a death benefit of cheap life insurance quote & coverage but also pay cash benefits should you encounter a chronic, critical or terminal illness.

Transamerica Living Benefits (LB)

Overall Issue Ages: 18-80

Full Medical Underwriting ($250,000 – $2,000,000)

Best available health class: Preferred

- 10 Year: 18-80

- 15 Year: 18-75

- 20 Year: 18-70

- 25 Year: 18-63

- 30 Year: 18-57

Non-Medical Exam ($25,000 – $249,999)

Best available health class: Standard

- 10 Year: 18-65

- 15 Year: 18-65

- 20 Year: 18-65

- 25 Year: 18-63

- 30 Year: 18-57

Conversion Option: Yes, Coverage can be converted into permanent life insurance without having to provide evidence of insurability. Conversion to permanent life insurance must be done before the insured’s 70th birthday. (75th birthday is original coverage was approved at Preferred Plus health class).

Included Policy Riders: Living Benefit Riders

Optional Policy Riders: Monthly Disability Income Rider, Income Protection Option, Disability Waiver of Premium Rider, Children’s Insurance Rider, Accidental Death Benefit Rider

Monthly Disability Income Rider: Can provide a monthly income for up to 24 months if the insured is totally disabled and are unable to perform their duties in their regular occupation.

Income Protection Option: This rider is optional and available at no additional costs. It allows the policyholder to structure how the death benefit should be paid out to the beneficiaries should the insured pass away.

Disability Waiver of Premium Rider: Will waive premium payments should the insured become totally disabled. There is a six-month wait from the start of the disability before premiums will be waived. Premiums will be waived up to age 65.

Children’s Insurance Rider: Provides level term insurance coverage on all the children of the insured up to age 25. The child is not required to take a medical exam and can have coverage up to $25,000. Once the child has reached the age of 25, coverage can be converted to permanent life insurance.

Accidental Death Benefit: This rider will pay out an additional death benefit up to $300,000 if death occurred as a result of an accident.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Transamerica Living Benefits LB Quote with Top Quote Life Insurance

Getting your Transamerica Life Insurance Living Benefits (LB) quote with top quote life insurance is super easy.

- Simply click the “Get Instant Quotes” button at the top of your screen.

- Enter your information in our quote software.

- Be sure to select an appropriate health classification class. For no exam you will need to select (standard).

- Click “View Quotes” for all your term life insurance results.

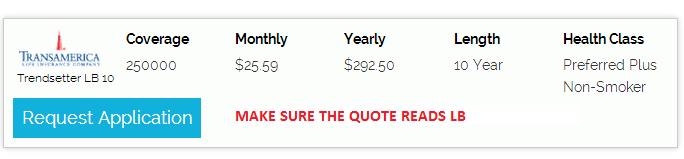

- The results will bring up all available term life insurance quotes as well as Transamerica traditional term and Transamerica Trendsetter Living Benefits (LB) Term. Remember you are looking for the Transamerica Life Insurance Logo. An easy way to confirm that you have selected the correct Transamerica life insurance policy is to look for the (LB) SYMBOL under the Transamerica logo.

Ask us about Transamerica Living Benefits

Top Quote Life Insurance is very excited about Transamerica Living Benefits (LB) term life insurance. We highly recommend our clients consider a living benefits policy when considering term life insurance coverage.

If you like the idea of a life insurance policy that pays you a portion of your death benefit should you become ill with a chronic, critical or terminal illness, then consider a Transamerica Living Benefits (LB) term life insurance policy.

Ready to Compare Life Insurance Rates?

It’s free, fast and super simple.

Looking to compare life insurance policies? We can help. Enter your ZIP code to get free quotes from multiple insurers.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

Farmers CSR for 4 Years

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.