Direct Term Life Insurance: What It Is And How It Works

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

Farmers CSR for 4 Years

UPDATED: Mar 25, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 25, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The internet has its ups and downs, but the one thing that we can probably all agree on is that it can often be helpful when it comes to shopping.

It isn’t easy to name something that you cannot readily purchase online or at the very least, find information to help you make a well-informed purchase of a particular item. Heck, you can even buy groceries online and have them delivered to your front step within a few hours from clicking the checkout button.

Online shopping is not going away anytime soon but rather becoming the preferred way to shop. Google data even reports that 84% of Americans are shopping for an item online in any given 48-hour period. 63% of those people will begin the initial shopping process online rather than in a brick and mortar establishment.

We can even bet that you heard of the online company that goes by the name of Amazon. Well, by 2023, it is projected that Amazon alone will account for 50% of all U.S. e-commerce shopping. Crazy right?

The big question that probably on your mind is can the same be done when it comes to purchasing something like term life insurance?

The short answer is yes, absolutely, and called direct term life insurance.

While the traditional way to purchase insurance is through a professional agent or agency, advancements in technology and advanced underwriting algorithms have led the way to what is referred to as direct to consumer life insurance (DTC) or direct term life insurance.

Looking to compare life insurance rates for free? Enter your ZIP code to get multiple quotes.

What is Direct Term Life Insurance?

Direct term life insurance is not necessarily a new form of life insurance but rather a more modern way to apply for life insurance that is done entirely online. As the name suggests, direct term life insurance describes purchasing life insurance directly from the insurance company rather than the traditional way of using the help of a licensed agent.

What often makes direct to consumer life insurance appealing is the way it is marketed as being a simple and much faster way to apply for term life insurance online. The term insurance plans are often designed to provide the potential for same-day approval without the need of having to take a medical exam in most cases.

The entire process can go from getting an initial quote to completing an online application and then to approval in as little as 24 hours or sooner. Underwriting is what can commonly be referred to as “simplified or accelerated” and relies on algorithms designed to aid in the overall approval process.

Although underwriting guidelines and medical exam requirements for direct term life insurance plans will vary depending on the company.

Read more: How to Compare Term Life Insurance Rates Online

Who Qualifies for Direct Term Life Insurance?

- Between the ages 18-55

- Have a history of good health

- Require temporary life insurance

- Coverage needs are less than $1,000,000

- Like the idea of not having to take a medical exam

- Are not interested in meeting face to face with an agent

- Would appreciate a simple and fast approval process

For many people, the convenience factor of purchasing life insurance directly from the insurance company makes it most appealing.

Although convenience can be beneficial, it’s important to realize that in many cases, you’re usually making a tradeoff when purchasing directly from a life insurance company. For example, you could be sacrificing certain policy features as well as cheaper rates for a speedy approval process.

Direct term life insurance isn’t for everyone. Like other types of insurance, you need some know-how to get the best policy for you, and that generally requires the help of an experienced life insurance agent.

In this article, we will explain who the coverage will benefit most as well as provide an overall overview of direct term life insurance, including the pros and cons. We’ll also share information about who the best digital life insurance companies are in 2020, including detailed information about their direct term insurance options, to help you determine which route to take to get the best insurance for you and your family.

But first, let’s get the basics of what term life insurance is out of the way first.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

What is the Definition of Term Life Insurance?

Term life insurance, by definition, is temporary life insurance that provides coverage for a specific but limited period of time. It is hands down the most popular form of life insurance coverage, mostly due to how affordable it is to own a policy.

Since term insurance is temporary insurance, it is often sold in several contract lengths that can last up to 10, 15, 20, or 30 years. You can now even find a few companies offering contract durations as long as 40 years. (For more information, read our “30 Year Term Life Insurance Contract Length“).

When you choose a contract length, your premium payments and death benefit amount are locked in for the entire duration of the contract. The policy will only pay out the full death benefit if death has occurred while the contract is active.

If you outlive your term contract, “which is fairly common,” you will have the option to let the policy terminate, which at that time coverage will end. If you still require coverage, you may have the opportunity to renew it or even convert your existing policy into a permanent plan without having to go through any new underwriting.

If you outlive your term insurance, it is crucial to understand that there is no cash value or investment aspect to term insurance plans. Many first time buyers of term insurance do not realize this. However, it is one of the main reasons why term insurance is significantly more affordable compared to permanent life insurance plans. (For more information, read our “Top 10 Best Reasons Why You Need to Buy Term Life Insurance“).

How Life Insurance Is Usually Purchased

Before direct to consumer life insurance, people would generally purchase their life insurance through a middleman in the form of an insurance agent.

Insurance companies rely on agents to meet with potential customers to help educate them about insurance options and offer a solution that can financially protect their loved ones due to the sudden passing of a family member. Before the internet, nearly all life insurance coverage had been purchased either by face to face appointments or by direct mail.

Life insurance agents can also be broken down into two types, which consist of captive and independent agents.

A captive insurance agent works directly for one company, either as a contractor or a full-time employee of the insurance company. Since these types of agents are employed directly by the insurance company, they are only allowed to offer the insurance company’s products and no others.

What would be an example of a captive company? Several, but not all, are those that can often provide property and casualty coverage such as home and auto in addition to life insurance. Some of the most popular captive life insurance companies include State Farm, American Family, and Liberty Mutual.

Independent agents, on the other hand, do not work for any particular company. They are often contracted with multiple companies and can compare policies and quotes from several different insurance companies, except for the captive companies.

While meeting face to face with a life insurance agent is still a highly popular and available option, the internet has changed the way people are going about buying life insurance.

The Online Life Insurance Agent

The internet has opened doors for both captive and independent agents to offer consumers a convenient way to shop for life insurance online. While face to face appointments and direct mail offerings remain an option to this day, the internet provided another means of offering life insurance.

Since you’re reading this online, you probably are aware that you can easily compare quotes from multiple companies by answering a few basic questions about yourself. You will also notice that you can even apply online with the help of an agent.

The fact is that the internet has streamlined the way people purchase everything, from life groceries to life insurance. This streamlining has also helped pave the way for direct term policies sold through Digital Life Insurance Companies.

Digital Life Insurance Companies & Direct Term Life Insurance

The concept of purchasing term life insurance directly from the insurer is relatively new. 2012 saw the first “digital life insurance companies” to hit the market, which ignited what we can now refer to as “direct term life insurance.” Since 2012, several digital life insurance companies have been popping up to offer a direct term life insurance solution.

Digital life insurance companies have become quite popular but, at times, also a bit misleading. If you spend some time searching online for the “best life insurance companies,” you’ll often find many independent reviews promoting these companies as your best choice for life insurance.

While they can be a good option, we wouldn’t necessarily agree that they are the best choice. Most of the reviews out there are only nominating these insurance companies because they are receiving an affiliate commission in doing so. In other words, they are receiving a kickback if you purchase coverage based on their recommendation.

In all reality, digital life insurance companies are not really life insurance companies at all; they are technically life insurance brokers.

You may be wondering why a digital insurance company would be confused as a life insurance company. These types of life insurance brokers are actually partnered up with one or more actual life insurance companies to offer a direct term life insurance plan.

They will often market the term insurance coverage as their own, but the policies are really being issued and backed by an actual life insurance company that has partnered with the insurance broker.

The majority of the life insurance companies that participate in these partnerships are generally some of the most well-known brands, which include names such as Banner Life, Brighthouse Financial, MassMutual, and North American Life, to name a few.

Digital life insurance companies are what we would consider as a new hybrid of life insurance brokers. Most of these companies are investor-backed startups that have a strong focus on combining insurance with technology, which is referred to as Insurtech.

Their primary focus is to make online life insurance shopping as easy as it can get by creating an entirely online and streamlined application process with no medical exams and quick approval without the help of an agent at all.

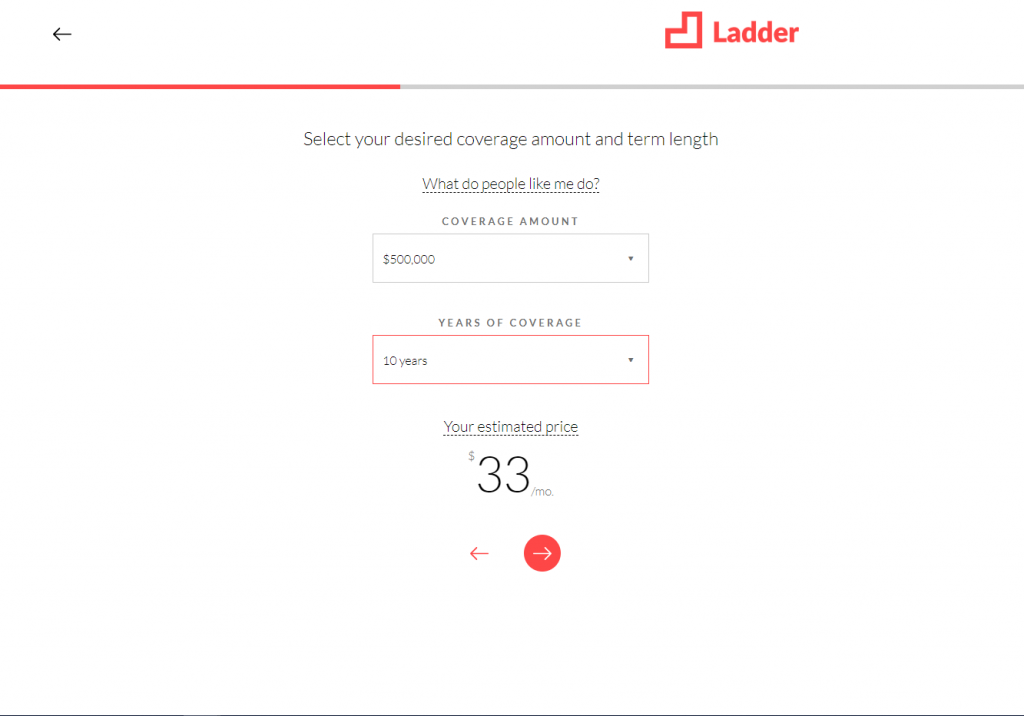

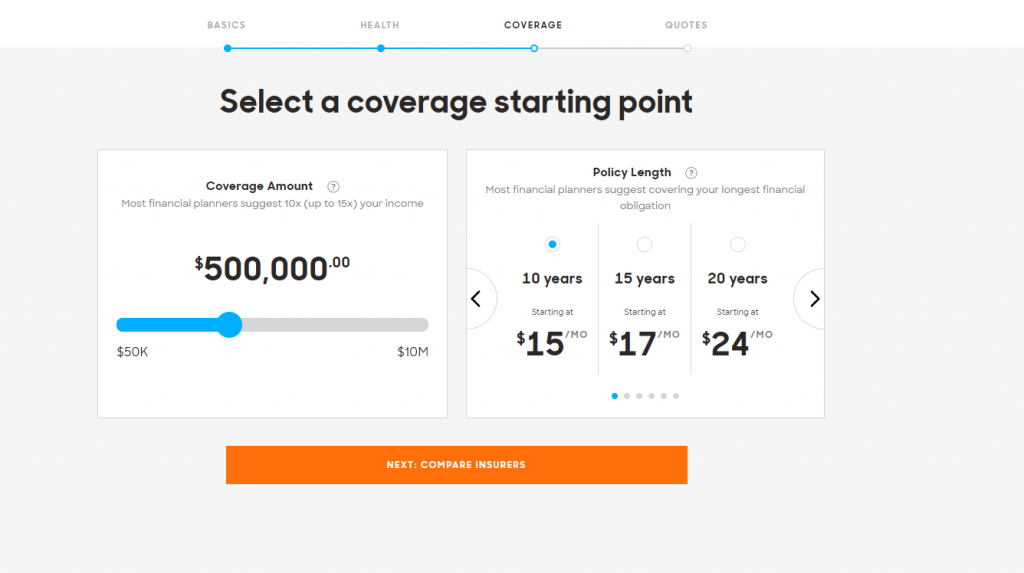

Direct Term Quote Process

The quote process and information you will need to provide will vary depending on the company. For the most part, you should be able to view rates instantly and without having to talk to anyone as this is just one of the many benefits direct term insurance provides.

The standard quote form is no different from any other online quote form. In order for rates to display, you will need to provide some basic information such as age, gender, tobacco use, coverage amount, and the length of coverage you are interested in.

Some quote forms can be a little lengthy and may ask for health questions upfront in order to pre-determine eligibility. If you find a quote form that is asking a lot of personal questions upfront it will most likely be able to provide a close to accurate rate prior to proceeding to the application.

If you’re happy with the rates you will have the option to create a personal account and continue onto the online application.

Application Process

Transitioning from receiving your quote to applying for the actual coverage can be done effortlessly. With direct term life insurance plans, there are no paper applications or agent assistance needed.

The electronic online application walks you through the entire process step by step. All you will need to do is provide answers to the application questions you are being asked. When completed, you’ll be required to sign the application using an electronic signature process.

When filling out an application, whether it be a paper application or an online application, be prepared to provide personal information about yourself. While it can be a little scary providing personal information online, rest assured that these companies have done everything in their power to make sure your data is secured.

How Eligibility is Determined

After completing your online application, you may be wondering about eligibility, especially if there is the possibility of not having to take a medical exam.

Most direct term life insurance companies rely on underwriting algorithms to gather eligibility information and provide a quick approval process.

The information they gather includes identity verification, prescription history, motor vehicle reports, and data from consumer reporting agencies. The algorithm works in part with data vendors such as the FCRA, HIPPA, and MIB to process the data and come up with either acceptance or rejection, giving you an answer in minutes.

This process can often skip the hassle of going for a medical exam. However, if you’re in good health, choosing a policy with a medical exam can potentially be cheaper than those without. For some, a quick medical exam is a worthy tradeoff for more affordable policy rates.

So, now you know how buying direct term life insurance can save you time, the next big question is who the companies that offer direct term life insurance coverage?

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

The Best Direct Term Life Insurance Companies

We’ve compiled a few highly-rated digital life insurance companies, complete with some of their best features. If you decide that direct term life insurance is right for you, any one of these companies can help you out.

Best Direct Term Life Insurance Companies in 2020

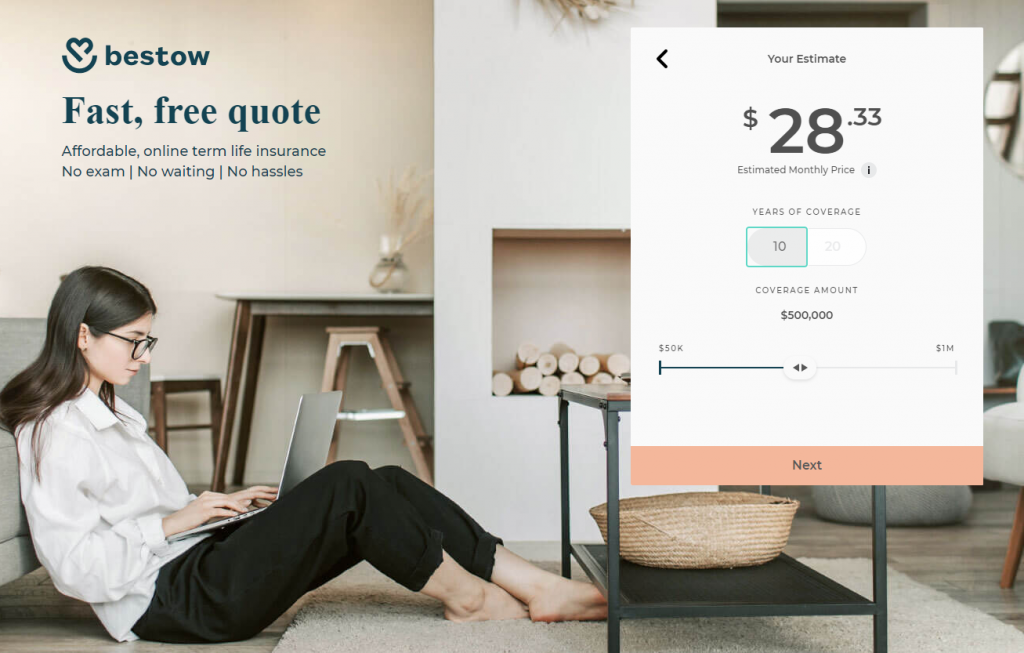

Bestow

Coverage is available starting as low as $50,000 and can go as high as $1,000,000 with no medical exams needed at all. Policies are issued through North American Company for Life and Health Insurance and Munich RE.

Read more: Bestow Life Insurance Company Review

What are the most significant benefits of Bestow Life?

The application process with Bestow is incredibly easy, and we are not kidding when we say you can complete your application and literally be approved for coverage in 5-10 minutes. While most direct term insurance options limit coverage to a minimum of $100,000, Bestow offers it as low as $50,000 for those looking to cover smaller needs such as funeral expenses.

What’s not to like about Bestow Life?

Bestow has more than a few drawbacks. For starters, contract lengths are only available in two options, 10 and 20 years. There are no extra policy features or even a conversion option to permanent coverage once the term insurance expires.

The age cutoff for coverage is young compared to many other companies. For example, a 10-year term policy with Bestow is age 55, whereas, with many other companies, it is age 80. Although the young age cutoff is partly due to the no medical exam underwriting, you can also find many other companies offering no exam underwriting up to age 65.

The final drawback to Bestow term insurance is the strict underwriting. Since you’re not being asked to take a medical exam to help provide proof of insurability if you have a history or any current medical issues, the odds of getting coverage are not likely.

| Bestow Term Life Insurance | |

|---|---|

| Company | Bestow |

| Founded | 2017 |

| Founders | Melbourne O’Banion Jonathan Abelmann |

| Coverage Provider | North American Life |

| AM Best Rating | A+ |

| Plan Name | Bestow Term Life Insurance |

| Issue Ages | 21-55 |

| Term Lengths | 10 Year (Ages 21-55) 20 Year (Ages 21-45) |

| Minimum Coverage | $50,000 |

| Maximum Coverage | $1,000,000 |

| Policy Riders | None |

| Conversion Option | None |

| Free Look Period | 30-Days |

| Medical Exam | Not Required |

| Approval Time | 5-10 Minutes |

Read more: 10 Year Term Life Insurance: Top 5 Companies

Be sure to read our full company review on Bestow Life Insurance to learn more about the insurance company and coverage options.

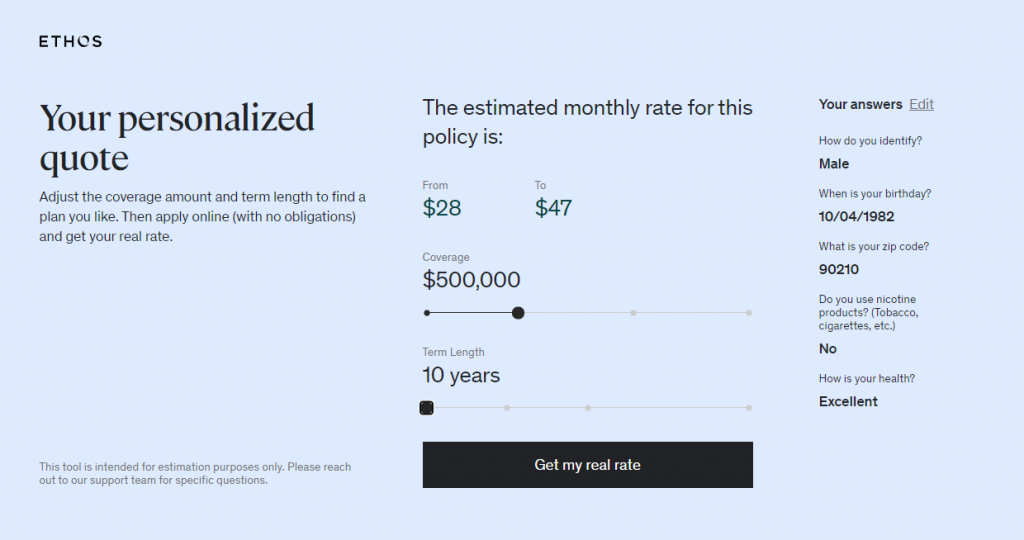

Ethos

Death benefit coverage begins at $100,000 with the option to apply for up to $1,5000,000 with several different term lengths to choose from.

What are the most significant benefits of Ethos Life Insurance?

An advantage Ethos brings to the table is with its high issue ages and multiple-term lengths. The maximum age cutoff for a 10-year term policy is 65 when others are age 60 or younger.

Ethos also offers a free accelerated death benefit policy that can advance the death benefit should the insured become ill with a terminal illness.

What’s not to like about Ethos Life Insurance?

Ethos doesn’t offer a conversion option, so once the term coverage has ended, you will need to reassess your life insurance needs and re-apply if you still require protection.

When applying for coverage, Ethos will try to qualify its customers without the need for a medical exam. However, there is a chance that an exam may be required should the underwriter require additional medical information.

While having to take a medical exam may not be your ideal preference, it can potentially save you from receiving a decline. For those who are looking for a true non-medical option may not find Ethos as the best option for coverage.

| Ethos Term Life Insurance | |

|---|---|

| Company | Ethos Life |

| Founded | 2016 |

| Founders | Peter Colis Lingke Wang |

| Coverage Provider | Banner Life |

| AM Best Rating | A+ |

| Plan Name | Ethos Term Life Insurance |

| Issue Ages | 20-65 |

| Term Lengths | 10, 15, 20 & 30 Years |

| Minimum Coverage | $100,000 |

| Maximum Coverage | $1,500,000 |

| Policy Riders | Accelerated Death Benefit |

| Conversion Option | None |

| Free Look Period | 30-Days |

| Medical Exam | Could be required |

| Approval Time | Immediate up to a few days |

Be sure to read our full company review on Ethos Life Insurance to learn more about the insurance company and coverage options.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

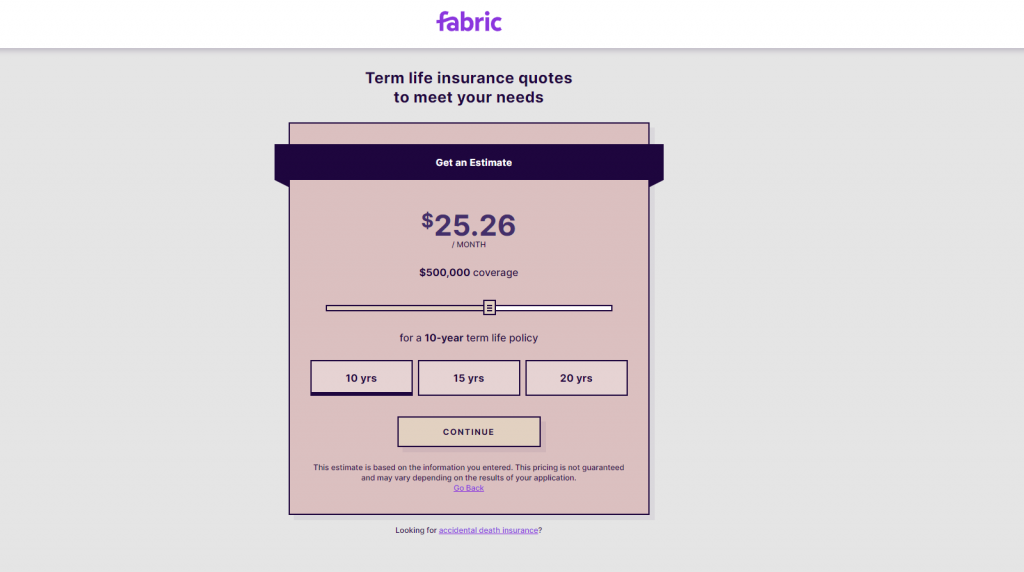

Fabric

Applying online with Fabric is a 10-minute process with an opportunity for no medical exam instant approval. In addition to a direct term insurance option, Fabric also offers an affordable guaranteed issue accidental death benefit policy.

What are the most significant benefits of Fabric Life Insurance?

Fabric offers two convenient options when it comes to applying for its term life insurance coverage. The first is through the company’s website, where you can easily compare rates and continue to the application process, which can be completed in 10 minutes.

The second option is through a Fabric designed app that can be downloaded through the Apple and Google Play Store. The app not only allows you to view rates and apply for coverage but includes a way to create a will and even manage your family’s finances.

When it comes to the actual life insurance coverage that Fabric offers, we like that there is a conversion option to permanent coverage. Fabric also offers a $5,000,000 maximum death benefit, which is more than enough to most families’ life insurance needs.

What’s not to like about Fabric Life Insurance?

The biggest drawback to Fabric is that there is not a 30-year term life insurance option. The maximum term length is 20 years. Fabric term insurance does not offer any policy riders or living benefits in that matter. As with a few of the other direct term insurance options, you may be asked to take a medical exam if you do not meet underwriting guidelines for an instant issue.

| Fabric Term Life Insurance | |

|---|---|

| Company | Fabric |

| Founded | 2015 |

| Founders | Adam Erlebacher Steven Surgnier |

| Coverage Provider | Vantis Life |

| AM Best Rating | A+ |

| Plan Name | Fabric Term Life Insurance |

| Issue Ages | 21-60 |

| Term Lengths | 10, 15, & 20 Years |

| Minimum Coverage | $100,000 |

| Maximum Coverage | $5,000,000 |

| Policy Riders | None |

| Conversion Option | Yes |

| Free Look Period | 30-Days |

| Medical Exam | Could be required |

| Approval Time | Immediate up to a few days |

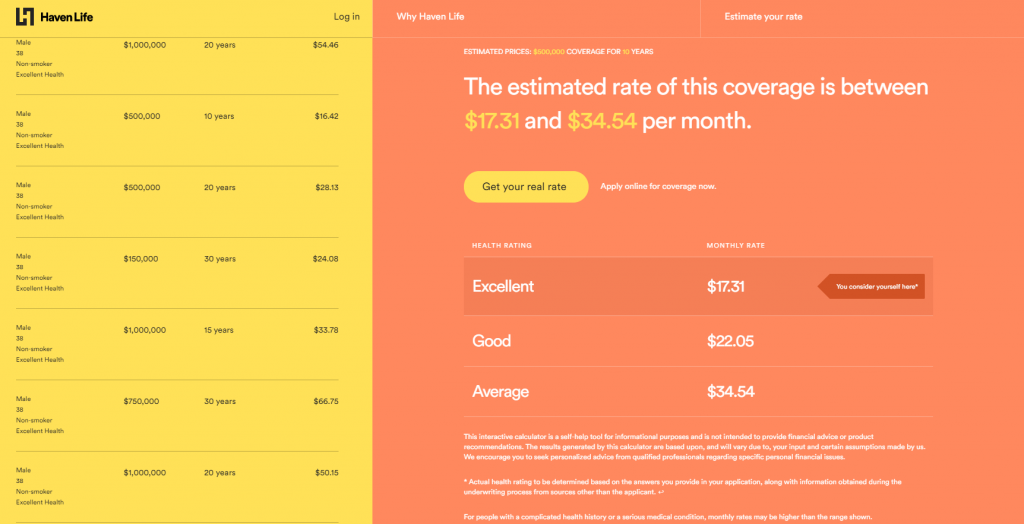

Haven Life

The first coverage option is the company’s most popular, and it offers up to $3 million in term life insurance protection. If your coverage needs are a million or less and you are in excellent health, you may qualify for instant issue approval.

Whereas Haven Life’s most popular term life insurance option may require a medical exam to get the best rates, their Haven Term Simplified coverage may let you skip the medical exam entirely.

With Haven Term Simplified, you can apply for up to $500,000 without a medical exam, but beware your health classification will be at standard rates. A standard rating will be a bit more expensive than if you were to take a medical exam and qualify for preferred approval.

What are the most significant benefits of Haven Life Insurance?

There is no doubt that the most significant benefit to getting a policy with Haven Life is that the coverage is backed by one of the largest and strongest insurance companies in the industry. You and your family can rest assured that you’re in good hands should a claim ever arise.

By having two different term options, you have the luxury of deciding whether or not you want to take a medical exam. If you do decide to purchase coverage with Haven Life, your policy will also come with a few benefits such as an accelerated death benefit option and the Haven Life Plus rider, which provides discounts to several services.

What’s not to like about Haven Life Insurance?

There is not much to dislike about Haven Life Insurance. A lack of a conversion option can be the largest concern to buying a Haven term life insurance policy, but other than that, they are a solid choice for term insurance coverage.

| Haven Term Life Insurance | |

|---|---|

| Company | Haven Life |

| Founded | 2014 |

| Founders | Yaron Ben-Zvi |

| Coverage Provider | MassMutual |

| AM Best Rating | A++ |

| Plan Name | Haven Term Life Insurance |

| Issue Ages | 18-64 |

| Term Lengths | 10, 15, 20 & 30 Years |

| Minimum Coverage | $100,000 |

| Maximum Coverage | $3,000,000 |

| Policy Riders | Accelerated Death Benefit, Haven Life Plus & Waiver of Premium |

| Conversion Option | No |

| Free Look Period | 30-Days |

| Medical Exam | Could be required |

| Approval Time | Immediate up to a few days |

Be sure to read our full company review on Haven Life Insurance to learn more about the insurance company and coverage options.

Ladder Life

What are the most significant benefits of Ladder Life Insurance?

What makes Ladder unique is what happens after you purchase life insurance coverage with the company. When you enroll for a term insurance policy, you will have your own user dashboard. Within that dashboard, you have access to adjust your death benefit easily should your life insurance needs change later in life.

For example, let’s say you purchased a $1,000,000 term life insurance policy for 30 years. Twenty years later, your mortgage is paid off, and you no longer need a full $1,000,000 policy.

With Ladder, all you need to do is access your online account and simply lower your coverage. By doing so, your death benefit is reduced to the amount you feel is required, and your premium is automatically lowered. Should your life insurance needs increase, you can also access your account and apply for additional coverage.

Ladder offers the highest amount of coverage out of all direct term insurance carriers coming in at $8,000,000, making the company an excellent choice for families as well as businesses that require higher amounts of life insurance.

When it comes to choosing a contract length, Ladder Life offers the most options ranging from 10 through 30 years.

What’s not to like about Ladder Life Insurance?

As with a few of the other direct term insurance options, Ladder does not offer any policy rider or even a conversion option. The company’s “unique” laddering feature is not so unique.

Most companies will allow for decreases in coverage without any issues, which is nothing new. Increases will require evidence of insurability, which is also no different from any other life insurance company. In other words, increasing your coverage is not guaranteed to happen, especially if you have a change in health later in life.

| Ladder Term Life Insurance | |

|---|---|

| Company | Ladder Life |

| Founded | 2015 |

| Founders | Jamie Hale |

| Coverage Provider | Fidelity Security Life |

| AM Best Rating | A |

| Plan Name | Ladder Term Life Insurance |

| Issue Ages | 20-60 |

| Term Lengths | 10, 15, 20, 25 & 30 Years |

| Minimum Coverage | $100,000 |

| Maximum Coverage | $8,000,000 |

| Policy Riders | None |

| Conversion Option | No |

| Free Look Period | 30-Days |

| Medical Exam | Could be required |

| Approval Time | Immediate up to a few days |

Be sure to read our full company review on Ladder Life Insurance to learn more about the insurance company and coverage options.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Policygenius

SimplySelect is a non-medical exam direct term insurance policy that offers an approval time within 24 hours of completing the online application. The insurance coverage requires absolutely no medical exams with coverage beginning at $100,000 up to $2,000,000.

What are the most significant benefits of Policygenius Life Insurance?

Policygenius offers a benefit that none of the other digital term life insurance providers can offer, and that’s the ability to shop your coverage with multiple life insurance companies. Although Policygenius has recently partnered up with Brighthouse Financial, it is not the only company the online insurance broker offers.

Policygenius is what you would consider an independent broker, and they have contracted with well over a dozen top-rated life insurance companies. If their new direct term life insurance plan doesn’t fit your coverage needs, they will have other options to provide you with.

What’s not to like about Policygenius Life Insurance?

It’s hard to say anything negative about Policygenius. Since they are an independent insurance broker, they can offer so many more options than any of the other digital life insurance providers listed on our list.

If we are purely looking at the company’s new direct term insurance option, the biggest drawback is that coverage is only available up to age 49. However, even with a lower than usual age cutoff, Policygenius is going to be able to offer you several excellent term insurance options outside of SimplySelect should you not meet the guidelines for coverage.

| Policygenius Term Life Insurance | |

|---|---|

| Company | Policygenius |

| Founded | 2014 |

| Founders | Jennifer Fitzgerald |

| Coverage Provider | Brighthouse Financial |

| AM Best Rating | A |

| Plan Name | Policygenius Term Life Insurance |

| Issue Ages | 25-49 |

| Term Lengths | 10, 20 & 30 Years |

| Minimum Coverage | $100,000 |

| Maximum Coverage | $2,000,000 |

| Policy Riders | Acceleration of Death Benefit |

| Conversion Option | Yes |

| Free Look Period | 30-Days |

| Medical Exam | Not required |

| Approval Time | Within 24 hours |

Be sure to read our full company review on Policygenius Life Insurance to learn more about the insurance company and coverage options.

Will Buying Direct Term Life Insurance Save You Money?

An important piece of information that most consumers are not aware of is that life insurance rates are regulated by law. What this means is that if more than one agency or life insurance broker is offering the same identical coverage from the same identical life insurance provider, there cannot be a difference in the prices.

However, there is an exception to this rule. Every digital life insurance provider that offers a direct term life insurance coverage is partnered with a major life insurance company. In nearly every case, that same life insurance company is also available to independent agents as well.

Where there can be a price difference between an independent broker and a digital life insurance broker is if the life insurance company has designed a direct term plan that is exclusive to the digital life insurance provider only and no other organization.

With that said, can buying a direct term life insurance save you money?

Most likely, no.

Direct Term Insurance Rates vs. Non-Direct Term Insurance Rates

The life insurance industry is highly competitive, with several companies competing to be your life insurance provider. The difference between rates between companies can range from a few pennies up to a couple of hundred dollars.

Digital life insurance companies that offer a direct term life insurance option add to the competitiveness when searching for the best rates. Although plans can offer competitive prices, it’s often rare that they will be the cheapest option.

The below chart is actual sample rates comparing life insurance rates from non-direct term insurance plans versus a few of the most popular direct term life insurance plans.

Direct Term Life Insurance Rates

The below comparison table represents rates for both males and females that would be considered to have an excellent history of health with no tobacco use. The rates reflect an estimated cost for a 10-year term life insurance plan with a death benefit of $500,000.

| AGE | BESTOW | ETHOS | FABRIC | HAVEN LIFE | LADDER LIFE | POLICYGENIUS |

|---|---|---|---|---|---|---|

| 30 | $23.33 (M) $16.25 (F) |

$23.00 (M) $15.00 (F) |

$20.60 (M) $19.35 (F) |

$14.72 (M) $13.00 (F) |

$20.00 (M) $19.00 (F) |

See Rates |

| 35 | $25.83 (M) $18.33 (F) |

$25.00 (M) $21.00 (F) |

$21.23 (M) $19.98 (F) |

$16.02 (M) $13.86 (F) |

$22.00 (M) $20.00 (F) |

See Rates |

| 40 | $32.91 (M) $23.33 (F) |

$34.00 (M) $27.00 (F) |

$27.95 (M) $25.61 (F) |

$20.32 (M) $18.60 (F) |

$29.00 (M) $26.00 (F) |

See Rates |

| 45 | $43.33 (M) $31.25 (F) |

$49.00 (M) $38.00 (F) |

$34.67 (M) $31.25 (F) |

$32.81 (M) $28.51 (F) |

$45.00 (M) $37.00 (F) |

See Rates |

| 50 | $60.41 (M) $42.91 (F) |

$75.00 (M) $58.00 (F) |

$57.39 (M) $45.45 (F) |

$50.47 (M) $40.57 (F) |

$66.00 (M) $53.00 (F) |

See Rates |

| 55 | NA | $113.00 (M) $87.00 (F) |

$80.11 (M) $59.65 (F) |

$84.92 (M) $61.67 (F) |

$106.00 (M) $78.00 (F) |

See Rates |

| 60 | NA | $183.00 (M) $139.00 (F) |

$150.78 (M) $98.16 (F) |

$139.61 (M) $90.95 (F) |

NA | See Rates |

| 65 | NA | $259.00 (M) $203.00 (F) |

NA | NA | NA | See Rates |

Non-Direct Term Life Insurance Rates

Choosing a non-direct term life insurance option that would generally be purchased through an independent agent can provide term insurance options up to age 80. To be fair, we wanted to give a comparison close to what direct term life insurance companies can offer.

In the table below, we have chosen six different highly-rated life insurance companies that can all offer an accelerated non-medical underwriting, which is nearly identical to a direct term life insurance option.

The comparison below also represents potential rates for both males and females that would be considered to be in excellent health. The rates are based on the estimated cost for a 10-year term life insurance plan with a death benefit of $500,000.

| AGE | BANNER | LINCOLN | NORTH AMERICAN | PRINCIPAL | PROTECTIVE | SAGICOR |

|---|---|---|---|---|---|---|

| 30 | $19.80 (M) $13.39 (F) |

$14.48 (M) $11.99 (F) |

$14.52 (M) $11.98 (F) |

$15.44 (M) $13.28 (F) |

$14.03 (M) $12.22 (F) |

$14.49 (M) $12.29 (F) |

| 35 | $20.40 (M) $16.57 (F) |

$14.91 (M) $12.90 (F) |

$14.52 (M) $12.76 (F) |

$15.71 (M) $14.22 (F) |

$14.26 (M) $13.00 (F) |

$14.56 (M) $12.70 (F) |

| 40 | $25.29 (M) $20.61 (F) |

$19.43 (M) $16.87 (F) |

$18.48 (M) $16.28 (F) |

$20.20 (M) $18.24 (F) |

$18.44 (M) $16.73 (F) |

$18.65 (M) $15.11 (F) |

| 45 | $32.94 (M) $28.26 (F) |

$29.21 (M) $25.41 (F) |

$28.60 (M) $25.08 (F) |

$30.74 (M) $26.41 (F) |

$28.15 (M) $24.23 (F) |

$27.97 (M) $24.95 (F) |

| 50 | $50.79 (M) $41.01 (F) |

$42.75 (M) $35.92 (F) |

$42.24 (M) $38.88 (F) |

$45.13 (M) $37.15 (F) |

$40.80 (M) $33.98 (F) |

$63.75 (M) $49.73 (F) |

| 55 | NA | $70.57 (M) $52.40 (F) |

$69.96 (M) $51.92 (F) |

$74.12 (M) $53.96 (F) |

$67.58 (M) $50.06 (F) |

$98.14 (M) $71.95 (F) |

| 60 | NA | $114.09 (M) $75.90 (F) |

$113.08 (M) $75.24 (F) |

$119.99 (M) $81.24 (F) |

$109.23 (M) $72.68 (F) |

$158.30 (M) $98.42 (F) |

| 65 | NA | NA | NA | NA | NA | $275.01 (M) $170.27 (F) |

Read more: Life Insurance Death Benefit: The Most Important Features Explained

Pros and Cons of Direct Term Life Insurance

Purchasing life insurance is not difficult to do. However, making sure you choose the right policy for you and your family can be another story. With hundreds of life insurance companies offering life insurance plans, how do you know which one is going to be the best?

Can a direct term life insurance plan be the perfect solution?

If we refer back to findings found in LIMRA’s 2019 Fact About Life Insurance, 47% of consumers want a simplified approach when it comes to purchasing life insurance. Although direct term life insurance plans are relatively new, we must admit that the process of getting coverage meets what most consumers want.

To help you make a well-informed decision as to whether or not direct term life insurance plans will be the best life insurance option for you, we have put together a detailed list of all the pros and cons that come with these plans.

Pros of Buying Direct Term Life Insurance

- Fast Approval

- Backed By Big Companies

- Competitive Rates

- No Medical Exam Potential

- Online Application Process

Fast Approval

Direct term life insurance plans are designed to offer a fast decision for coverage. Most approvals can be made within a few minutes from completing your online application.

Backed By Big Companies

The majority of direct term life insurance plans are offered through digital life insurance companies such as the ones named in this article. However, the actual term life insurance coverage you are purchasing is often backed by a big name insurance company.

The insurance company in nearly all cases will have an AM Best rating of at least an A grade or higher. Rest assured that these insurance companies have been around for a long time and have a strong financial ability in being able to pay out claims to its customer’s beneficiaries.

Competitive Rates

Although you’re likely to find cheaper rates for coverage by shopping the entire market, for the vast majority of people, prices from direct term companies will be competitive.

No Medical Exam (Usually)

Another great benefit of purchasing directly from a life insurance company is the reduced hassle. The term insurance plans generally don’t require a medical exam for approval.

Instead, the insurance company utilizes algorithms in order to provide simplified underwriting to determine eligibility all of which is done instantaneously.

Completely Online

Another way direct term life companies reduce hassle is by streamlining their application process. They allow people to do everything online and at their own pace without any face-to-face conversations.

So, if you like your quote you receive online, you can fill out the application on your computer or even your cell phone.

Cons of Buying Direct Term Life Insurance

- Limited Options

- Losing Money

- Limited Policy Features & Riders

- Tough Underwriting

- Limited Age Range

- No Permanent Coverage Options

Limited Options

The most significant drawback of purchasing directly from a life insurance company is the limited policy options. When you work with a direct term life insurance provider, they are not going to be able to shop the entire market to find you the best option. They are only going to be able to offer you their products, and that is often limited to term life insurance.

Losing Money

When you get a direct term life quote, you’re getting that quote from only one company. You don’t have the luxury of comparing rates from multiple providers. As a result, you may not be getting the best deal based on what other companies can offer on comparable coverage.

Keep in mind, life insurance rates between the different providers can have a difference in prices as high as 70%. By not comparing rates from multiple providers, it can potentially result in paying a few hundred dollars extra for your coverage.

Missing Out On Features and Riders

Life insurance companies can offer many different features and policy riders within their policies. The problem is, it’s hard to know which features are best for you and what companies are offering them.

Direct term life insurance plans often focus on providing the means of getting life insurance coverage quickly without the extra add-ons. While in theory, this may sound great, you may be missing out on plans that can offer living benefits or even conversion options both of which can be beneficial should you get sick later in life.

Life insurance has come a long way since the start and many plans today offer several different features that are built into the coverage. Working with an agent will be able to tell you which company will offer the best policy riders for your situation.

Health Risks Often Mean Rejection

Direct term life insurance plans often have strict underwriting guidelines. Since their business model is about providing fast coverage without medical exams, they often can only accept the healthiest applicants for the model to work.

Those who have health concerns are often rejected and denied coverage. If a direct term life insurance company’s algorithm rejects your application due to medical risks, there’s not much you can do other than bounce from company to company until you find one willing to provide coverage.

Strict Age Limits

Again, due to the business model, direct term life insurance plans often limit the age guidelines for its term insurance plans to ages 18-60.

Seniors will not benefit from purchasing a direct term life insurance policy especially if they are over the age limit or have medical concerns.

No Permanent Options

While term life insurance is the best option for most, it’s not for everyone. If you’re looking for a permanent life insurance policy such as guaranteed universal life or whole life insurance, you simply can’t get one.

Direct term life insurance companies only deal in term life insurance. They offer no permanent options whatsoever and, in many cases, not even a conversion option on the term plans.

Read more: Top Life Insurance Company That Offers Term Life Conversion

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Why Working With an Agent or an Agency is Still Best

What if we told you that many, if not all the cons of direct term life insurance can be avoided when working with an experienced life insurance agent or agency? The truth is that agents are still widely popular today for several reasons.

Independent agents, in particular, can compare quotes and plans from many different companies to find you not only the best rate but also the best overall policy but that’s just one example.

Personal Touch and Guidance

Many prefer working with agents for their personal touch and guidance. An agent’s job is to listen to their customer’s life insurance needs and make professional recommendations based on those needs.

In addition to making life insurance recommendations, an agent helps assist their customer in obtaining the coverage they need to provide financial protection for their family. When approved, customer service doesn’t end there. A life insurance agent provides service to their clients well after approval has been made.

If an insurance company rejects you for an unforeseen underwriting result, an independent agent can utilize the medical reason to help shop and suggest other companies that may be willing to insure you.

If you’re denied a policy with a direct term provider, you will have to navigate those waters yourself. This usually means starting the whole process over with another company, without knowing exactly why you were rejected in the first place. An independent agent will be able to explain your options and guide you to the best company for your situation. (For more information, read our “Life Insurance Buyer’s Guide“).

Just because one company declines you doesn’t necessarily mean that you are a decline with every company. Every insurance company views health risks differently. It’s just another way that they stay competitive amongst each other.

Read more: Life Insurance Agents: Independent vs Captive

Agents Are Online Too

Working with an agent or even an agency doesn’t necessarily mean getting in your car and driving to an office to discuss life insurance. Thanks to the internet, nearly every life insurance company offers an online application process.

Several providers even offer coverage that is identical, if not better, than what some of the direct term life insurance plans provide today. The majority of life insurance plans that are available today work with simplified underwriting and utilize algorithms to determine eligibility for a quick approval process.

While not every applicant will qualify for a speedy approval process, you’ll still likely have the option to take a medical exam to prove your eligibility. Direct term insurance on the hand will not give you this option.

Final Thoughts: Licensed Agent or Direct Term Life Insurance?

You’re making a trade-off when you buy direct term life insurance instead of working with an insurance agent. Agents are useful because their job is to find the best deal and educate their customers.

When buying directly from a company, it’s your job to educate yourself on the various products and often complicated life insurance industry. Unless you’re already familiar with the ins and outs of term life insurance policies, it can cost you money to buy direct term insurance from the first company that looks good.

Plus, life is complicated, and algorithms are no good in grey areas. This is why it’s best to seek a human touch for our life insurance needs. Buying direct is perfect for those who want coverage fast and are not necessarily worried about cost. But for those who want to make sure they have the best protection at the best price, independent agents are the way to go.

Ready to Compare Life Insurance Rates?

It’s free, fast, and super simple.

Looking to get free life insurance quotes? Enter your ZIP code to get started.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

Farmers CSR for 4 Years

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.