Page with sidebar Layout

Share this post

Share on facebook

Share on linkedin

Share on twitter

Share on pinterest

Share on print

Share on email

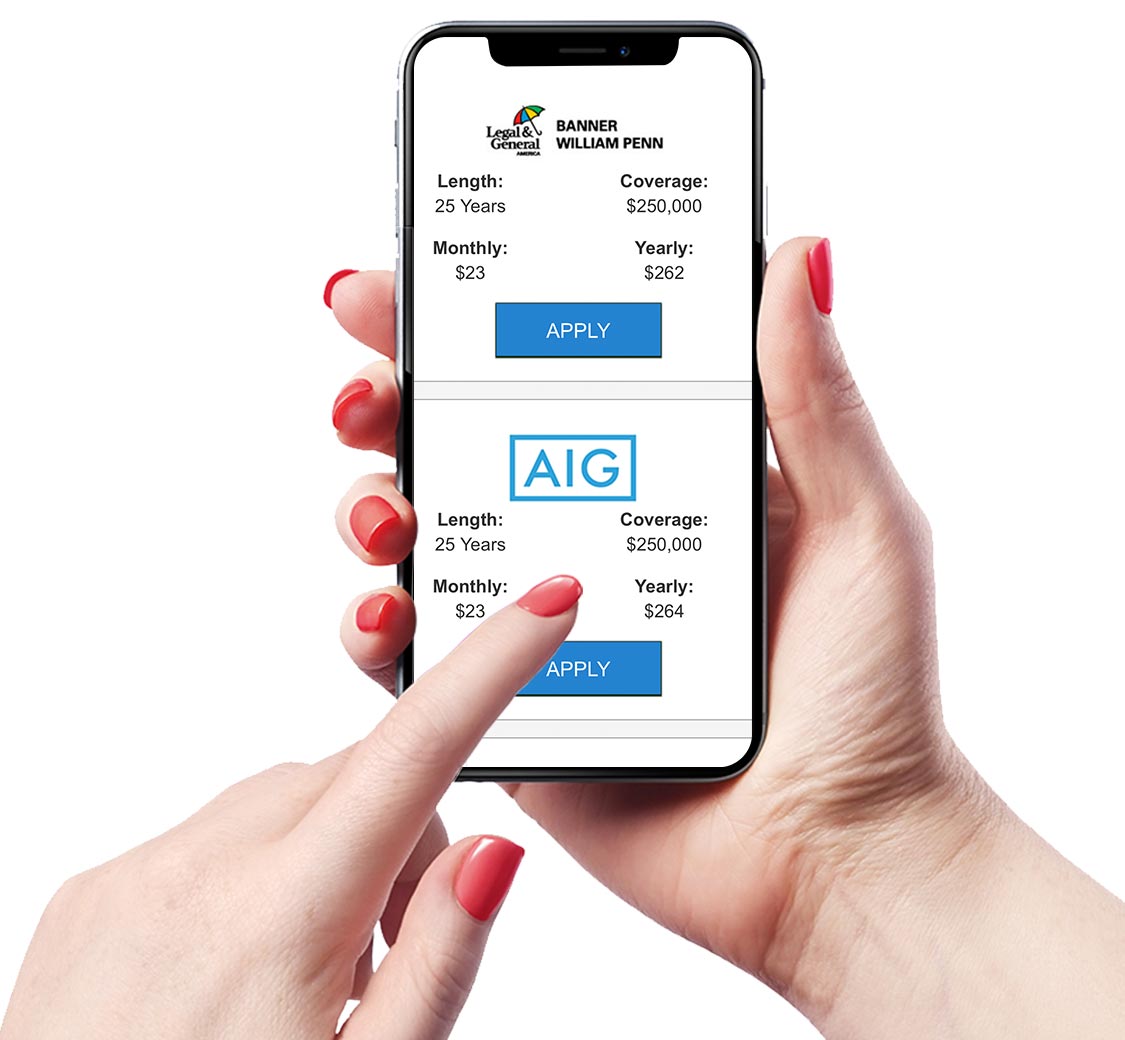

Instant Life Insurance Rates

Instantly compare life insurance rates from over two dozen of the best life insurance companies.

Get Quotes

INSTANT

Ready to Shop for GreatLife Insurance Rates?

Purchasing Life Insurance has never been easier

Ready to Shop for GreatLife Insurance Rates?

Purchasing Life Insurance has never been easier

Looking to compare life insurance policies? We can help. Enter your ZIP code to get free quotes from multiple insurers.