Ladder Life Insurance Company Review of 2026

Are you looking for a insurance company that offers fast, easy, convenient insurance without the hassle? If so, a Ladder insurance quote just might be what you’re looking for.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

Farmers CSR for 4 Years

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Are you looking for a life insurance company that offers fast, easy, convenient life insurance without the hassle of a medical exam, reams of paperwork, and endless wait times? If so, Ladder life insurance just might be what you’re looking for. We hope this Ladder Life insurance review will answer most, if not all of the questions you may have.

Looking to compare term life insurance quotes? Enter your ZIP code above to get started.

What is Ladder Life?

Ladder Life insurance company is an up-and-coming insurtech (insurance combined with technology) startup that offers a fully digital online life insurance experience. The online-based company serves as a type of life insurance broker that provides an exclusive direct term life insurance application process with policies being backed and issued through Fidelity Security Life Insurance Company and Allianz of New York.

Though relatively young, Ladder Life has already provided thousands of satisfied customers with life insurance policies. They offer extensive, potentially no medical term life insurance policies in a matter of minutes to qualified customers.

The key function that sets Ladder Life apart from other insurance providers is the ability for customers to “ladder” their insurance needs. No matter what stage you’re at in life, you can adjust your policy by increasing or lowering the death benefit amount to the level of coverage needed, effectively “laddering” coverage. This is not very common as an industry standard among other life insurers.

How did Ladder Life get started?

Jamie Hale, CEO, and co-founder of Ladder is the man behind the inspiration for Ladder Life. His early life was marked by the importance of having a life insurance policy when his father passed away. Because his father had purchased a policy, Jamie’s mom was able to care for her children, and Jamie’s education through graduate school was covered.

Later in life, while working in equity investment management, Jamie fielded numerous questions from friends wanting to purchase life insurance. Many were frustrated with the process which resulted in several pages of paperwork and an endless waiting game. He decided then to create a life insurance company that would make the entire process quick and painless, adding to many positive customer experiences. Ladder Life officially launched in 2015.

Ladder Life Investors

A large part of the success of Ladder Life becoming as big as they are is due to the investors that have jumped on board with the digital life insurance broker. To successfully market the insurance company and provide the technology that makes the online quote and application process to be as smooth and user-friendly as possible, requires a significant amount of funding.

Ladder Life has gained interest and financial backing from not one but multiple investors to help fund the company’s overall growth with its user-friendly technology and marketing. In fact, in the first 100 days from launching Ladder Life, the digital life insurance broker issued over $100 million of coverage through its online platform. This has only added to the company’s financial stability.

Investors Backing Ladder Life

- 8VC

- Allianz Life Ventures

- Canaan

- Lightspeed

- Northwestern Mutual Future Ventures

- NYCA

- Thomvest Ventures

Partnership with Fidelity Security Life Insurance Company and Allianz

When it comes to life insurance, you depend on the company you purchase a policy through to be around for many years. You also rely on them to pay out on a claim to your family members if the need arises. Without substantial financial backing, insurance companies aren’t worth the paper they print your policy on. That is why solid financial backing is vital.

Ladder Life, on the other hand, is not a life insurance company but rather an insurance broker that offers a direct-to-consumer term life insurance plan. They don’t directly pay out the policy if you need to file a claim.

Who does? Their partners, Fidelity Life Insurance Company and Allianz, are for New York residents. Both of these companies have strong financial backings, are fully invested in offering life insurance policies for customers who sign up through Ladder Life, and are projected to be around for years to come.

Their partnership provides customers with the security that claims will be paid out whether they need to file a claim five, twenty, or forty years from today.

Hannover Re Reinsurer Partnership

In addition to partnering up with Fidelity and Allianz, Ladder partnered with Hannover Re to provide reinsurance. A reinsurer, such as Hannover, helps cover substantial risks that one insurance company alone cannot handle. Thanks to this partnership, Ladder can offer policies up to $8 million in coverage, which is significantly higher than what their competitors are offering.

Ladder Life Headquarters Location

Ladder Life is headquartered in Palo Alto, California, and supports a dynamic working environment. If you were to show interest in Ladder Life careers, you’d be hard-pressed to find a more vibrant place to work.

Employees for Ladder Life enjoy perks such as catered lunches, commuter benefits, fitness expenses, and incredible benefits. Why do they offer their employees so much? Their employees are dedicated, hardworking members of a team that focuses on you, the customer. Hard work deserves benefits that match.

At present, Ladder Life has an office staffed by twenty-eight employees. This small group of dedicated individuals performs every task from answering calls and emails to facilitating life insurance claims for all fifty states and providing payouts.

When you call Ladder Life, you might get an answering machine.

Why?

Because Ladder is committed to giving you a personalized experience, rather than a robot, if you leave a message, a Ladder employee will call you back as soon as they can to help you through any concerns or questions you may have.

We would also like to note that Ladder Life employees are not commissioned-based, they are salaried paid employees. If you call in for questions you won’t feel pressured into purchasing coverage on the spot.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Ladder Life Customer Reviews with TrustPilot

Ladder Life insurance reviews from their customers are overwhelmingly positive, as recorded by TrustPilot. Ladder ranks at a high 4.8 out of 5 with over 1,900 customer reviews on Trustpilot. While looking into what past customers had to say about their experience with the online-based life insurance broker, the mass majority had nothing but nice things to say.

We had noticed several customers commented on how simple and straightforward the application process was while others appreciated the customer service they received was both friendly and quick to respond.

Although the majority of reviews are positive, the negative remarks looked to be from applicants that did not meet the non-medical underwriting guidelines and were asked to take a medical exam to complete the application process. Other negative reviews stem from applicants initial quotes being much higher after underwriting was completed, and approval had been made. A few were also from applicants that were declined for coverage due to having a medical risk that disqualified them from getting coverage altogether.

To be fair, the total amount of reviews that ranged from average to poor only equaled 6%, while reviews that ranged from great to excellent totaled 94%. The majority of Ladder Life customers had a great experience in working with Ladder Life.

Ladder Life BBB Rating

One of the most popular and oldest customer review sites is the Better Business Bureau. It is often a place many of us rely on to view information and customer reviews on a company that we may have an interest in working with.

Ladder Life, however, is not an accredited business with the Better Business Bureau, nor does the company have a profile with the organization.

Ladder Life on Reddit

While not so much a rating or review site, we noticed a few Reddit posts on the topic of Ladder Life. The discussions on the popular web forum range from pros and cons to independent opinions regarding the insurance broker Ladder Life.

While Reddit forums can provide some helpful information, we still highly recommend speaking with a licensed agent when you have questions about life insurance to make sure you’re getting accurate information on the subject.

Fidelity Security Life Insurance Company and Allianz Ratings

When considering reviews and ratings for Ladder Life, it is also just as important to take into consideration ratings of the actual insurance company that will be providing the life insurance coverage.

Remember, Ladder Life is the life insurance broker and not the ones who are supplying the actual life insurance coverage, that would be Fidelity Security Life or Allianz Life if you live in New York.

Rest assured, both Fidelity Security Life and Allianz have received high ratings that establish their trustworthiness in backing the payout of claims and policies purchased through Ladder Life.

Fidelity Security Life receives the following ratings:

| Fidelity Security Life Company Ratings | |

|---|---|

| AM Best Rating: | A (Excellent) |

| Fitch Rating: | Not Rated |

| Moody’s Rating: | Not Rated |

| S&P Global Rating: | Not Rated |

| Better Business Bureau Rating: | A+ Accredited Business |

What do these ratings mean?

In short, AM Best, Fitch, Standard & Poors, and Moody’s are all independent credit rating agencies that specialize in the insurance industry. They provide peace of mind to insurance consumers that are concerned about purchasing their life insurance coverage from a financially strong and stable company.

Rating agencies analyze data from participating insurance companies to provide an overall company rating. Although it’s only the opinion of the rating agency, the rating an insurance company receives from one or more of these agencies reflects the overall financial strength and claims-paying ability it has to its customers.

Ratings are in the form of letter grades, which are very similar to a report card that you would have received in school. An insurance company that receives a letter grade of A+ is going to be a better score than a company that has received a letter grade of an F.

An “A” rating from A.M. Best means Fidelity Security Life has an excellent ability to meet therein ongoing insurance obligations. The letter grade ranks the third highest out of a total of 16 possible letter grades. The (A) letter grade represents a credit quality of excellent.

Fidelity Security Life has not been rated by Fitch, S&P, or Moody’s. However, when it comes to life insurance, the AM Best rating scale is the system most commonly used.

Allianz Life Insurance New York receives the following:

| Allianz Company Ratings | |

|---|---|

| AM Best Rating: | A+ (Superior) |

| Fitch Rating: | Not Rated |

| Moody’s Rating: | A1 (Low Credit Risk) |

| S&P Global Rating: | AA (Very Strong) |

| Better Business Bureau Rating: | A+ Accredited Business |

If you are a resident of New York and are considering purchasing life insurance with Ladder Life, your policy will be issued by Allianz Life Insurance Company of New York.

Read more: Allianz Life Insurance Review

A.M. Best has rated Allianz with an A+ rating of superior. The letter grade ranks as the second-highest rating out of 16 possible letter grades. Allianz has also received high ratings from both Moody’s and Standard & Poors.

Both sets of ratings show that Fidelity and Allianz for New York are reliable companies that will have no issue in paying out any claims filed through Ladder Life.

Ladder Life Fast Facts

Ladder Life has enjoyed a lot of success in its few short years since making life insurance available through its unique streamlined application and underwriting process. Here are several fast facts you might find interesting.

January 2020: Ladder was recognized by Money Magazine for being one of the best life insurance providers of 2020.

December 2019: Ladder donates 17,000 meals to families in need.

November 2019: Ladder launched its first TV commercial with testimonials from customers. Ladder is recognized as a leading insurtech company.

August 2019: Ladder named Real Simple’s 2019 Smart Money Award Winner

July 2019: Ladder named Insurtech Business of the Year by Fintech Awards, also recognized for providing the best term life insurance management tool.

Ladder Life Marketing

I literally Googled best online life insurance and Ladder life insurance popped up.

If you spend some time on social media and have also begun searching online for life insurance coverage, you won’t be surprised to come across a Ladder Life ad.

Ladder Life markets its term life insurance plan through several social media channels with display ads and videos ad. Their popular Ladder Customer Testimonial video has received well over a hundred thousand views in just a short couple of months.

Ladder Life Insurance Options

Ladder Life only offers term life insurance. Permanent plans such as whole life insurance are often viewed as complex life insurance products due to the investment portion. Because of its complexity, it doesn’t fit the simple and straightforward approach to life insurance that Ladder Life offers its customers.

For a vast majority of people, term life insurance will be the perfect and most affordable life insurance option, especially for young families who have a high need for financial protection.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Ladder Term Life Insurance

You choose a contract length along with a death benefit that will provide enough financial security that your surviving family members can continue living the same lifestyle.

When you purchase a term insurance policy, your premiums and death benefit are locked in for the entire duration of the contract. Once the term insurance contract ends, coverage terminates.

| Ladder Term Insurance | |

|---|---|

| Coverage Offered: | Term Life Insurance |

| Available Term Lengths: | 10, 15, 20, 25 & 30 Years |

| Eligible Ages: | 10-Year Term: Ages 20-60 15-Year Term: Ages 20-55 20-Year Term: Ages 20-50 25-Year Term: Ages 20-45 30-Year Term: Ages 20-40 |

| Coverage Amounts: | $100,000 up to $8,000,000 |

| Medical Exam Requirements: | Accelerated Non-Medical Exam Underwriting |

| Underwriting Difficulty: | Ideal for healthy applicants. Some health risks will still qualify but may require a medical exam before approval. |

| Approval Time: | Instantly up to a few days if a medical exam is required. |

| State Availability: | All 50 States |

Issue Ages

Ladder term insurance is available to applicants ages 20-60. To be eligible to apply, you must be a U.S. citizen or permanent resident with a minimum of two years of lawful residency within the U.S.

Contract Lengths

If you meet the age guidelines for coverage, you will need to decide on a contract length. Ladder life offers multiple options to choose from, such as a 10, 15, 20, 25, and 30-year duration.

Issue ages and contract lengths work hand in hand. Each term length has a maximum age cutoff that is not to exceed the age of 70, as shown below:

- 20-40 years old = 30-year maximum term length

- 20-45 years old = 25-year maximum term length

- 20-50 years old = 20-year maximum term length

- 20-55 years old = 15-year maximum term length

- 20-60 years old = 10-year maximum term length

There is an important factor when it comes to choosing a term length, and it has to do with your age at the time you apply for a plan. Ladder term life insurance plans utilize what is called age nearest underwriting. What this means is that if you are within 6 months of your upcoming birthday, your age is rounded up.

For example, let’s say you are 40 and interested in a 30-year term length. Your 41st birthday is three months away. Ladder Life would consider you to be age 41, preventing you from getting the 30-year term length. Instead, the highest term contract for a 41-year-old with Ladder Life would be the 25-year option.

Ladder term life insurance policies are also not available to seniors or anyone that is over the age of 60. Be sure to consider these age and term limits before applying through Ladder. If you need a longer term than their age limit allows, you’ll need to look elsewhere.

Available Policy Riders

Ladder Life does not offer any policy riders on its term insurance plans. Optional features and benefits such as accidental death, children’s term insurance, conversion options, or a waiver of premium rider are not available. As most policy riders add to the overall cost of the coverage, Ladder keeps the prices down but does not offer them.

Renewable

Ladder term life insurance is renewable up to five years past the original contract length. The premium will be higher but it can be beneficial if you need a few additional years of coverage and do not wish to go through any new underwriting.

No Medical Exams

All applicants ages 20-60 applying for Ladder term life insurance will be allowed to qualify for coverage without the potential of a medical exam. If eligible, approval for coverage can be made within minutes of completing the online application.

Flexible Coverage Changes

One benefit to Ladder Life policies is the ability to “ladder” or change the amount of coverage through the duration of your policy. If you purchase a 20-year plan for $500,000 in coverage but need to increase your death benefit to $1 million due to life changes, Ladder allows you to do that.

Their allowance for policy adjustment works in reverse, as well. If you need less coverage overtime, Ladder allows you to downsize your coverage amount straight from your online account 24/7.

To change your coverage amount, simply:

- Go to your Account Page

- Select the “View Policy” option

- Select “Decrease Coverage” or “Increase Coverage”

- Adjust the amount needed

Keep in mind that when increasing coverage, there may be a chance you will be required to take a medical exam. This can potentially happen if your coverage is more than what is allowed under the non-medical exam limits. An exam can also be required if your health had changed from when you initially purchased your life insurance plan. With that said, increasing your life insurance coverage with Ladder’s flexible coverage changes is not guaranteed.

On the other hand, when decreasing coverage, you will not be required to take a medical exam. Lowering your coverage will also reduce your premium payment to reflect the price of the lowered coverage amount. A decrease in the overall coverage is guaranteed, provided it is not less than the minimum death benefit amount of $50,000.

Ladder Life Quotes & Application Process

Getting a quote and applying for coverage can be done within minutes.

Visible at the top right corner of the company website is a large red button that reads “GET STARTED.” When clicked, you will begin the process of getting an “estimated quote.” An estimated quote has the potential to become your “real rates,” depending on the outcome of underwriting.

The initial quote process is a bit longer compared to other online quote options. You will begin by providing your level of knowledge regarding life insurance, followed by a series of basic questions such as:

- Gender

- Height & Weight

- Tobacco Use

- Birthdate

- Parents & Siblings Health

- Household Income

- How many children you have

- Remaining Mortgage Balance

Read more: Buying Life Insurance For Parents: What Steps (You) Need To Know

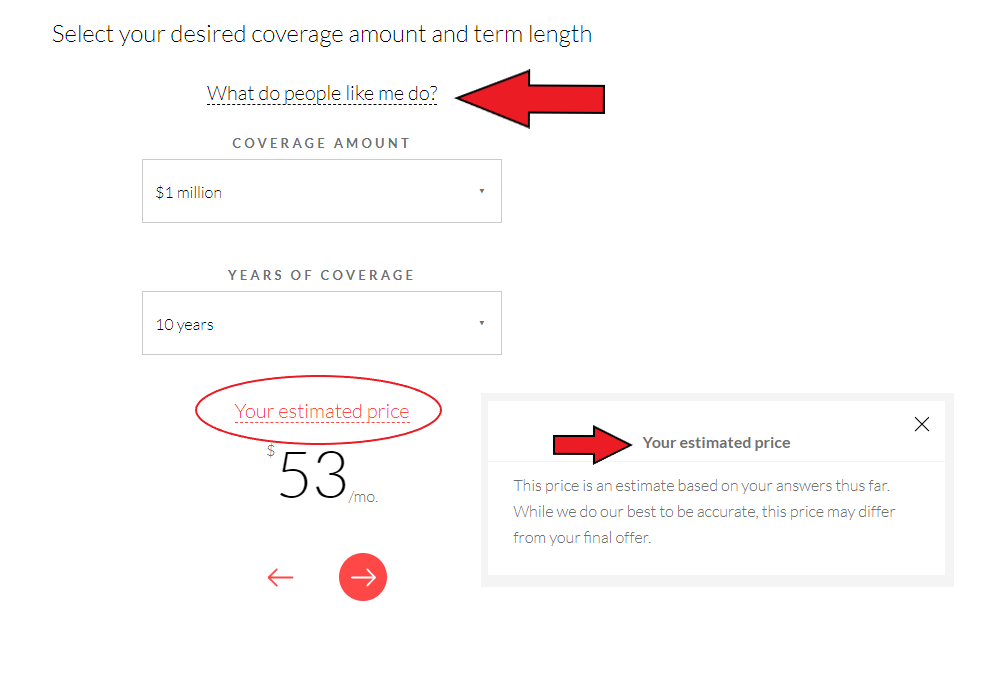

The final section of the quote process will ask for you to select the desired coverage amount and term length. As you choose from a dropdown menu, you instantly see your “estimated price” compute as you choose your option.

Ladder Life Insurance Quote Calculator

If you’re unsure about how much life insurance coverage you should have, Ladder Life will help you figure that out by offering two easy solutions.

The first option is a recommendation based on the series of questions you had previously answered before getting to the point of having to select a coverage amount and term length. You can simply click the “What do people like me do?” link on the quote page, and Ladder Life will recommend both a coverage amount and term length based on the information you have provided.

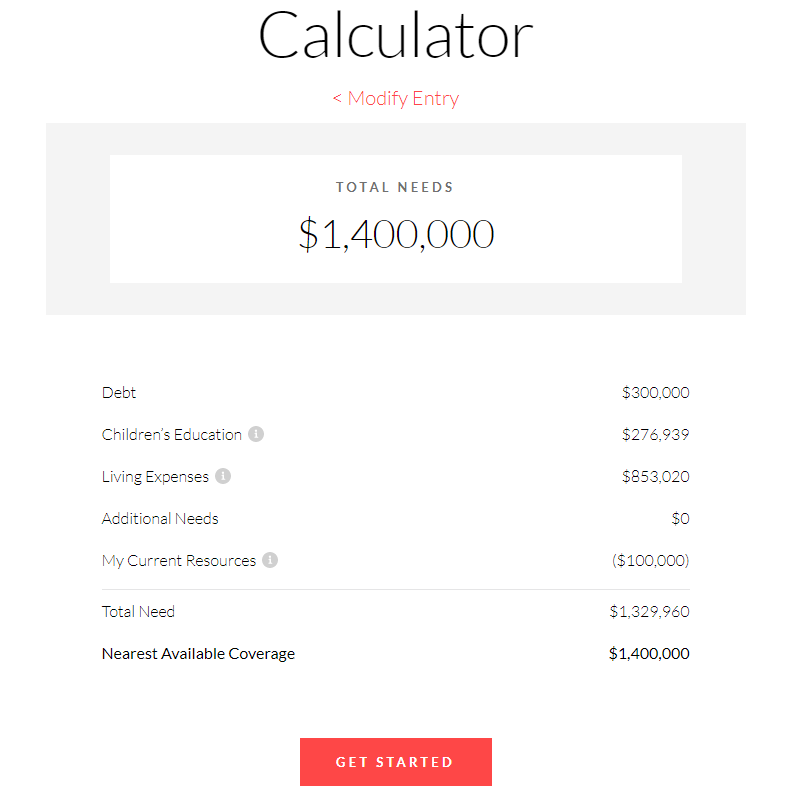

If you prefer a more detailed recommendation, Ladder Life offers an easy-to-use life insurance calculator. The online calculator makes a recommendation for life insurance coverage based on a few important questions about reasons why you would need life insurance in the first place. For the life insurance calculator to help determine an amount of coverage, you will need to provide answers to the following:

- Mortgage Balance

- Total Outstanding Debts

- Number of Children Included Ages

- Annual Income and Number of Years Beneficiary Would Need

- Lump-Sum Money for Final Expenses

- Any Existing Coverage

- Amount

After you’ve entered amounts for each of these areas, the calculator will suggest a coverage amount that adequately provides for your family, debts, and income needed in case of your death.

The only issue with the Ladder life calculator is that it doesn’t offer a suggested term length. When choosing a term length, it may be tempting to go with a 10-year option as it will be the cheapest.

However, after 10 years, should you still need coverage, you will need to go through re-approval, and rates will be higher since you will be 10 years older. Choosing the lowest term length is not always the best option.

Read more: How Does a Life Insurance Calculator Work?

Ladder Life Insurance Quote Application Questions

After seeing your potential rates for coverage, you can choose to continue with the application by clicking the red arrow below your estimated price. From there, you will begin the app, which can be completed in a total time of 5-10 minutes.

Here’s what your typical application process with Ladder looks like.

- Create Account

- Use Calculator

- Fill Out Application

- Optional Temporary Coverage

- Lab Test – (Only if Required)

- Final Approval

When completing the Ladder Life application, be prepared to answer health-related questions. The responses to these questions will not only help the underwriter determine eligibility for coverage but also whether or not a medical exam or medical records will be required to help assist in the underwriting process.

- Any Risky Hobbies (Skydiving, Parachuting, Scuba Diving, Vehicle or Boat Racing, etc.)

- Planned Travel Outside the US

- Plans to Fly as a Pilot

- Marijuana Use

- Narcotics Use

- Misdemeanor or Felony Convictions

- Moving Violations

- Weight Change of 10 pounds in the last year

- Treatment for health conditions in the last 10 years

- Consulted a Physician in the past 5 years

- Recommended to have treatment or diagnostic tests in the past 5 years

- Prescribed medications in the past 12 months

- Recommended to undergo organ, bone marrow, or tissue transplant

- Ever diagnosed or treated for AIDS, ARC, and or HIV infection

In addition to health-related questions, your application will also require you to provide a portion of personal information to confirm your identity.

- Full Name

- Address

- Telephone Number

- Citizenship

- Birth State

- Employment Status

- Occupation

- Annual Income

- Existing Coverage

- Status of Application for Coverage in the Past 5 Years

- Drivers License Number

- Social Security Number

How does Ladder temporary coverage work?

During the underwriting process, Ladder offers the option to add temporary coverage until you’re approved for your plan. To receive temporary coverage, you’ll be required to fill out an application and pay for your first month’s premium upfront.

The benefit of paying for your temporary coverage lies in the fact that if you die before the underwriting process is complete, your beneficiaries will receive the coverage amount you applied for. Ladder’s temporary coverage provides peace of mind during the underwriting process for you and your loved ones.

FREE Life Insurance Quotes

Underwriting Results & Approval

The final portion of the Ladder Life application comes down to underwriting. If all goes as planned, you will receive notification within your account that you have been approved for instant coverage with no medical exam being required. In most cases, you should receive a response to your application within minutes of applying.

How does Ladder Life offer instant term life insurance coverage?

Ladder Life founder Jamie Hale explained in an article posted on Medium, that their instant issue term life insurance utilizes algorithmic underwriting that incorporates hundreds of data points to assess an applicant’s overall risk to provide an instant decision.

The simplified underwriting process can drastically cut down the traditional time it takes to get a life insurance policy (6-8 weeks) and cut it down to a same-day approval.

Medical Exam

Unfortunately, not everyone will qualify for instant approval with Ladder Life, and some applicants will be required to take a medical exam if they wish to continue with the application. If your life insurance application does require a medical exam, you have the option as to whether or not you would like to continue.

However, if you agree to take a medical exam, one will be provided to you at no cost. It is a standard medical exam that is used by all life insurance companies that helps the underwriter get a better picture of your overall risk to the company.

A life insurance medical exam takes roughly 30 minutes and involves a licensed medical examiner coming out to your home or workplace to conduct the exam. The typical life insurance medical exam consists of a few health questions, blood pressure readings, a check of your height and weight, and a sample of both blood and urine.

Once you have completed your exam, Ladder Life will post your lab result in your user dashboard, so you have them for your records.

What would prevent getting a no exam underwriting decision?

This is a common question that is often asked, but the truth is, it’s impossible to answer. There is not a set guideline as to what risks or health conditions require an exam and which ones don’t require an exam. The algorithm and data points determine who will and will not need an exam.

While there is not a set of guidelines on who will and will not require a medical exam, applicants who have a history of excellent health, are not on prescriptions, and are within weight guidelines will generally qualify for non-medical exam approval.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Ladder Life Term Insurance Rates

Are Ladder Life term life insurance rates competitive?

Ladder Life offers competitive rates, but they are far from being the cheapest option for term insurance. The internet has made it beyond easy to compare quotes from nearly every provider that offers a life insurance policy. The days of having to call numerous insurance companies or brokers to get the best price for coverage are long gone.

Websites, such as Top Quote Life Insurance, can do it all for you with a few clicks of a button and even without having to speak to anyone if you prefer. Ladder Life also provides the ability to view its term insurance rates, and they do not require any upfront contact information.

Because Ladder Life is an online broker that offers its own term life insurance plan, you will not be able to compare the rates of other providers to see just how competitive their prices are.

So to help you out, we have put together a comparison chart of a few companies that offer a comparable term insurance product to give you an idea of what you can expect to pay for similar coverage versus Ladder Life coverage.

Ladder Life Comparison Rates – Males

- Male

- Age 30-60

- Excellent Health

- Non-Smoker

- 10 Year Term Length

- $1,000,000 Death Benefit

- Accelerated Non-Medical Exam Underwriting

| AGE | Ladder Life | Lincoln | Principal | Prudential | Securian |

|---|---|---|---|---|---|

| 30 | $32.00 | $20.82 | $22.99 | $35.44 | $20.68 |

| 35 | $32.00 | $22.97 | $24.77 | $35.44 | $22.44 |

| 40 | $40.00 | $29.17 | $30.61 | $46.82 | $32.12 |

| 45 | $64.00 | $48.52 | $51.30 | $65.19 | $52.36 |

| 50 | $103.00 | $75.59 | $78.81 | $91.44 | $79.64 |

| 55 | $177.00 | $132.56 | $137.07 | $134.32 | 139.48 |

| 60 | $290.00 | $218.75 | $228.33 | $218.32 | $223.96 |

Ladder Life Comparison Rates – Females

- Female

- Age 30-60

- Excellent Health

- Non-Smoker

- 10 Year Term Length

- $1,000,000 Death Benefit

- Accelerated Non-Medical Exam Underwriting

| AGE | Ladder Life | Lincoln | Principal | Prudential | Securian |

|---|---|---|---|---|---|

| 30 | $28.00 | $16.69 | $19.96 | $30.19 | $18.04 |

| 35 | $28.00 | $20.21 | $21.51 | $30.19 | $18.92 |

| 40 | $38.00 | $27.05 | $28.51 | $37.19 | $25.08 |

| 45 | $59.00 | $43.27 | $44.87 | $55.57 | $44.44 |

| 50 | $86.00 | $62.14 | $64.14 | $80.94 | $61.16 |

| 55 | $129.00 | $97.17 | $100.24 | $95.82 | $97.24 |

| 60 | $192.00 | $141.96 | $149.51 | $145.69 | $146.52 |

Other Ladder Life Insurance Options

If you’re looking for life insurance options beyond term insurance, with Ladder Life, you’ll be out of luck. As mentioned earlier, Ladder Life only offers term life insurance. For other options, you’ll need to apply through an independent insurance agency such as Top Quote for additional coverage options such as:

- Whole Life

- Term Conversions

- Policy Riders

- Children Plans

- Policies for Seniors

Ladder At Work

In 2018 Ladder Life introduced its employer-sponsored life insurance program called “Ladder@Work”. The program provides a solution for employers to offer their employees their own individual term life insurance policy.

We want to make a very important note that Ladder at Work is not group-term insurance which can easily be mistaken at first glance.

The term insurance plan is no different than if you were to go to the Ladder Life website and apply directly online. A true group life insurance policy allows every participating employee to get coverage, even if there are employees that would not qualify for coverage on their own.

With Ladder at Work, not everyone will qualify, especially those that have high-risk health conditions.

Claim Processing and Payout

If a death claim were to arise, the actual claim payout would be paid out by either Fidelity Security Life or Allianz Life. Filing a claim is a simple process with Ladder. As a policyholder, your beneficiary would need to follow these steps to file a claim.

- Email or call Ladder Life with the deceased family member’s name, date of birth, and policy number.

- Beneficiaries fill out a claim form and provide additional documents requested by Ladder.

- Your claim is processed for validity.

- Payment is released in one lump sum payment.

As with any life insurance policy, money received in the form of a death claim paid to a beneficiary is, in most cases, not taxable. Death benefits are not payable if death was a result of suicide within the first two policy years or if fraud was committed in order to obtain coverage.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Ladder Life Competitors

Ladder Life has several insurance industry competitors. These companies primarily began offering insurance in the marketplace around 2013-2014 and are all digital online life insurance brokers that can provide either a direct term life insurance plan or direct to consumer life insurance plan.

Ladder Life’s Similar / Top Competitors Include:

- Bestow Insurance

- Ethos

- Fabric

- Haven Life

- Policygenius

Read more: Bestow Life Insurance Company Review

| INSURANCE COMPANY | FOUNDED | PROVIDER | AM BEST RATING | COVERAGE | ISSUE AGES | CONTRACT LENGTHS | COVERAGE AMOUNTS | POLICY RIDERS | CONVERSION OPTION | MEDICAL EXAM |

|---|---|---|---|---|---|---|---|---|---|---|

|

2015 | Fidelity Security Life | A | Term Insurance | 20-60 | 10, 15, 20, 25 & 30 Years | $100,000 – $8,000,000 | None | None | Possibly Required |

|

2017 | North American | A+ | Term Insurance | 21-55 | 10 & 20 Years | $50,000 – $1,000,000 | None | None | Not Required |

|

2016 | Banner Life | A+ | Term Insurance | 20-65 | 10, 15, 20 & 30 Years | $100,000 – $1,500,000 | Yes | None | Possibly Required |

|

2015 | Vantis Life | A+ | Term Insurance | 21-60 | 10, 15 & 20 Years | $100,000 – $5,000,000 | None | Available | Possibly Required |

|

2014 | MassMutual | A++ | Term Insurance | 18-64 | 10, 15, 20 & 30 Years | $100,000 – $3,000,000 | Yes | None | Possibly Required |

|

2014 | Brighthouse | A | Term Insurance | 25-49 | 10, 20 & 30 Years | $100,000 – $2,000,000 | Yes | Available | Not Required |

Bestow

- Up to $1,000,000 in Coverage

- 10 & 20 Year Term Lengths

- A+ Rated Partner

- Approval in 10 Minutes

Ethos

- Up to $1,500,000 in Coverage

- Multiple Term Lengths

- Coverage up to age 65

- Quick Non-Medical Approval

Fabric

- Up to $5,000,000 in Coverage

- Permanent Conversion Option

- Immediate Approval Process

- Optional Accidental Death Coverage

Haven Life

- Up to $3,000,000 in Coverage

- Backed by A++ Partner

- Free Living Benefits

- Optional Policy Riders

Policygenius

- Offers Multiple Providers

- Expert Advice

- Term & Permanent Options

- Coverage up to age 80

Ladder Life Pros and Cons

Overall, Ladder Life is a highly reliable company that offers customers a product based on speed, convenience, and preference. As with any company, however, there are both pros and cons to consider when looking into purchasing life insurance. Here are several of each for Ladder Life.

PROS

- Solid Backing

- Easy Application Process

- Fast Approval Times

- High Coverage Amounts

- Multiple Term Lengths

- Tech-Friendly Process

- Adjustable Death Benefit

CONS

- Limited Options

- Competitive Pricing

- Age Restrictions

- Certain Health Risks Can Be An Issue

- Max Age Limits for Term Lengths

- No Policy Riders

- You May Need To Take A Medical Exam

Pro #1: Solid Backing

Ladder Life is backed by two stable A-rated insurance companies. Thanks to their partnership with Fidelity Company and Allianz, customers can be completely confident that their life insurance policies will get paid out should a claim arise.

Pro #2: Easy Application Process

If you’re looking for a streamlined application process that takes less time than brewing your morning cup of coffee, this is it. Answer a few questions, click a few selections, and you’re done. It doesn’t get much easier than that.

Pro #3: Fast Approval Times

Want to find out whether you are accepted for your policy of choice? You’ll find out almost instantly with Ladder Life.

Pro #4: High Coverage Amounts

Compared to their direct-to-consumer competitors, Ladder Life is one of the few companies that offer customers up to a whopping $8 million in coverage. If you need high coverage, Ladder Life is your company.

Pro #5: Multiple Term Lengths

Ladder term insurance plans come available in multiple term lengths. While most of their competitors offer a 10, 20, or 30-year plan, Ladder Life sweetens the pot by including two additional term lengths, a 15 and 25-year option.

Having multiple term lengths to choose from can make sure you have the right plan in place that is going to last long enough to cover all your financial needs.

Pro #6: Tech-Friendly Process

Thanks to Ladder Life’s online underwriting process, you can apply for life insurance on your mobile phone during a break at work, while sitting at the park watching your kids play, or on a cruise vacation. (For more information, read our “Life Insurance Underwriting: What to Expect When Applying“).

Ladder Life provides the ultimate in fast, online underwriting with no in-person hassle. And best of all, they offer helpful and friendly customer service should you have questions or need assistance with the application.

Pro #7: Adjustable Death Benefit

Life is unpredictable, and coverage needs can become very different five or ten years after purchasing a life insurance policy.

Whether your coverage needs decrease or even increase, Ladder Life has made it easy to keep up with those ever-changing financial needs that require protection.

Ladder Life is the first company to design a user-friendly customer account that allows its policyholders the ability to conveniently decrease or increase the amount without having to speak to an agent or even fill out any paperwork.

Through a method called “laddering,” you can consistently structure your death benefit to meet those ever-changing coverage needs by lower or increasing the total amount of life insurance coverage.

Con #1: Limited Options

Ladder Life only offers term life insurance. If you’re looking for a whole life policy, you won’t be able to get it through Ladder Life. You’ll also have problems if you ever want to convert your term insurance policy into a whole life policy as the company offers no conversion option.

If you’re not familiar with what a conversion option is, it allows you to exchange your term coverage for a permanent plan without evidence of insurability. Most term plans offer a conversion option, and people tend to use it if they become ill or have had a decline in health that would prevent them from getting a new term insurance plan down the road.

Con #2: Competitive Pricing

While Ladder Life does offer relatively affordable rates, several other large companies, “as shown in the comparison rate chart,” can beat their pricing while providing a comparable plan. It’s best to check around and compare rates with other companies before signing on the dotted line.

Con #3: Age Restrictions

If you’re over 60 years old, you won’t be able to purchase a policy. As a result, Ladder Life isn’t a company for the senior citizen population.

Con #4: Certain Health Risks Can Be An Issue

If you have health conditions, it shouldn’t prevent you from trying to get coverage with Ladder Life. The company even states on its FAQ page listed under “Can I get coverage, even if I’ve had some health problems?” that they have been able to help many customers with health challenges obtain coverage.

The problem is when the health problem becomes too high of a risk that your application results in decline. Ladder Life is not going to help you shop around to find you a company that is willing to consider you.

For this reason, if you have any health issues, we highly recommend working with an independent agent that can shop your medical risk with multiple providers to make sure you’re always getting the best deal.

Con #5: Max Age Limits for Term Lengths

Ladder Life has some of the lowest maximum age limits for its term contract lengths. They are significantly lower than many other insurance companies.

For example, a 10-year term insurance policy with most of the more prominent named companies will allow applicants as old as age 80 to apply. Ladder Life limits its 10-year policy at age 60.

Con #6: No Policy Riders

Ladder Life offers no optional policy riders such as accidental death, accelerated death benefit, or return of premium.

While we respect the views Ladder Life has on not wanting to burden its customers with extra costs by adding policy riders, many of today’s riders can offer some exciting benefits.

Popular riders such as living benefits can be found on many of today’s term life insurance policies without having to pay an extra cost. A policy that offers living benefits has become one of the most desirable features as it provides an extremely beneficial benefit if you become ill.

Living benefits are what is commonly referred to as, life insurance you can use while you’re living. Having a living benefit rider on your term insurance policy can provide an early payout from the death benefit should you become ill with a chronic, critical, or terminal illness.

Not only can a living benefits policy provide quick funds to help pay for expenses if you get sick, but a few can also pay out a monthly disability benefit if you become injured and cannot work.

Con #7: You May Need To Take A Medical Exam

Ladder term life insurance plans are underwritten using an accelerated underwriting method. Policies that offer this type of underwriting can produce a quick turnaround for approval, but not everyone will qualify.

If you’re looking for a true no medical exam term life insurance policy, Ladder may not be your best option. You could be required to take a medical exam if you do not meet the accelerated underwriting guidelines.

Bottom Line: Is Ladder Life Insurance worth it?

Ladder Life insurance is a trustworthy company that makes purchasing term life insurance quick and painless. If you’re in the target age range of 20-60, are tech-savvy, and want a potentially no-medical option for your life insurance policy, Ladder Life is a company to consider.

With that said, is Ladder Life really the best online life insurance company?

We can’t say that they are the best company, but they are not a bad option. As always, Ladder Life is one of many available options you have when it comes to buying life insurance.

The biggest piece we can provide is not to rush into purchasing without doing your research. Ladder Life can offer convenience, but its term insurance is a bit more expensive than its competitors which can offer many more features at a much lower cost.

Need help shopping for coverage? Don’t hesitate to let us know.

Ready to Compare Life Insurance Rates?

It’s free, fast, and super simple. Enter your ZIP code to get started.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

Farmers CSR for 4 Years

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.