AIG vs. Nationwide Life Insurance in 2025 (Compare Rates & Policies Here!)

Explore AIG and Nationwide life insurance, with AIG’s minimum term coverage at $18 and Nationwide’s at $20 per month. AIG vs. Nationwide life insurance differs in options, as Nationwide provides a no-exam life insurance program, while AIG offers a guaranteed issue whole life insurance program.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,071 reviews

3,071 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

3,071 reviews

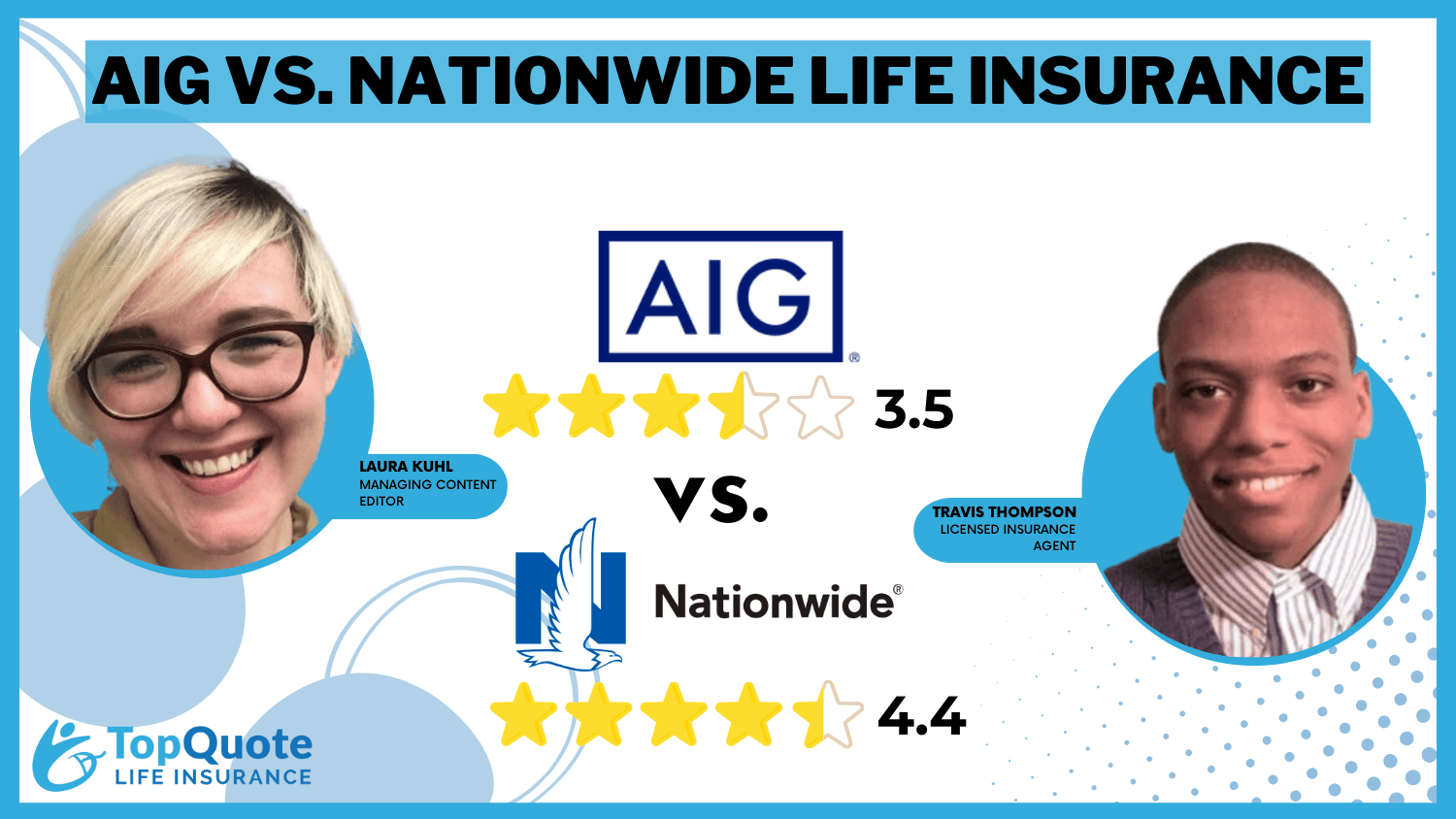

3,071 reviewsCompare AIG vs. Nationwide life insurance to understand how their special programs meet the needs of varying policyholders.

AIG’s Guaranteed issue whole life insurance program ensures that coverage is provided to those with medical concerns without any health exams.

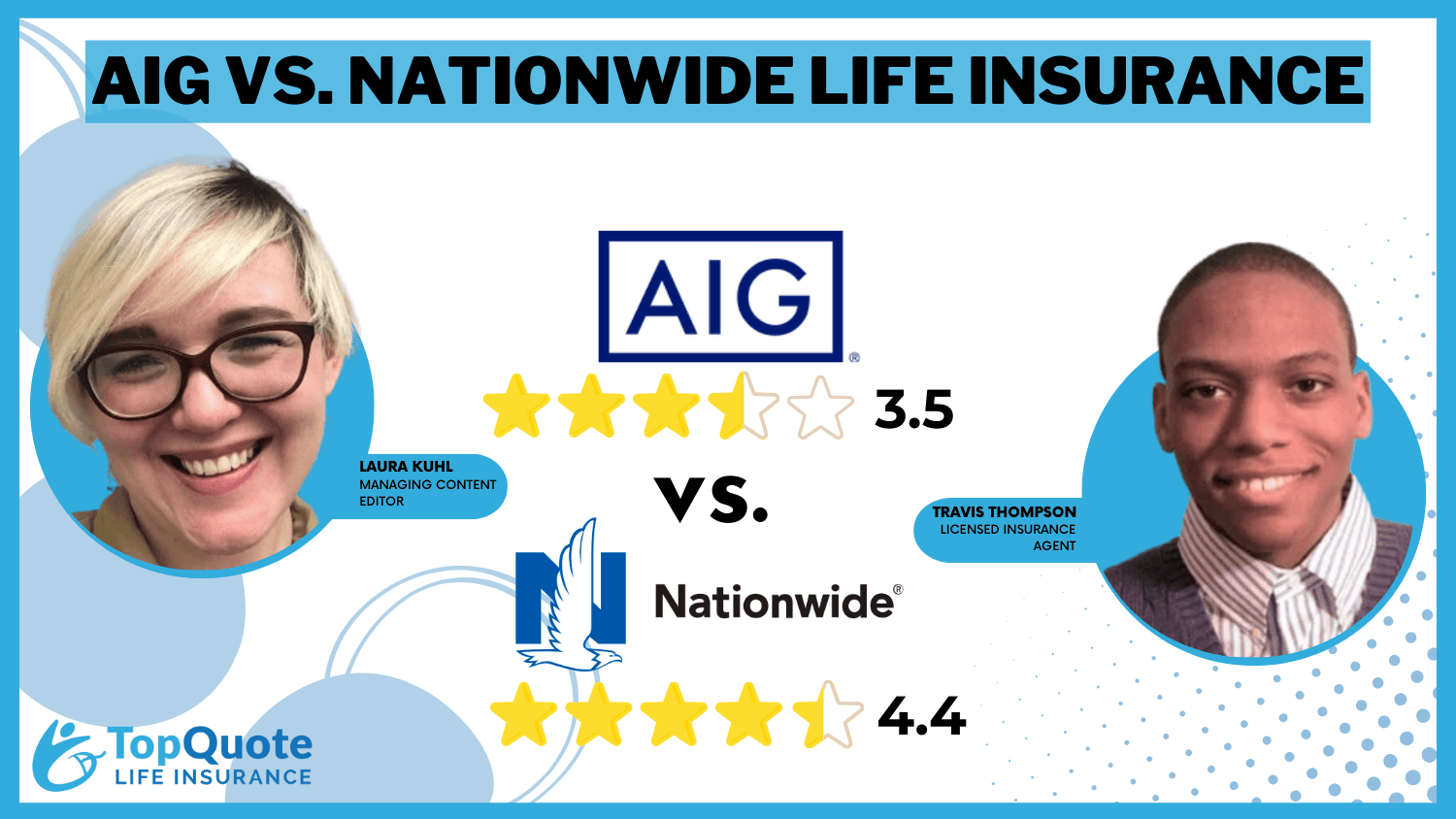

AIG vs. Nationwide Top Life Insurance Rating| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.5 | 4.4 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.0 | 3.5 |

| Company Reputation | 4.0 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.5 | 4.3 |

| Customer Satisfaction | 2.1 | 2.0 |

| Digital Experience | 4.0 | 4.5 |

| Discounts Available | 3.1 | 5.0 |

| Insurance Cost | 2.6 | 4.5 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 4.5 | 4.7 |

| Savings Potential | 2.8 | 4.7 |

| AIG Review | Nationwide Review |

Nationwide offers a No-Exam Life Insurance program, simplifying access for individuals seeking quicker approval.

Both companies also have differences in financial ratings and extra insurance options such as Long-Term Care Riders.

- Compare AIG vs. Nationwide life insurance for coverage options

- Some policies offer coverage without requiring any medical exams

- Financial ratings and policy benefits vary between both providers

Before diving into the AIG vs. Nationwide comparison, type your ZIP code using our free and helpful tool above to find quick life insurance quotes in your area.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

AIG vs. Nationwide Life Insurance Rate Comparison

This table compares AIG vs. Nationwide life insurance rates by age and gender. Nationwide offers lower monthly rates across all categories, with the largest difference seen in older policyholders.

AIG vs. Nationwide Whole Policy Life Insurance Monthly Rates by Age & Gender| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $183 | $172 |

| Age: 16 Male | $192 | $179 |

| Age: 30 Female | $118 | $114 |

| Age: 30 Male | $126 | $119 |

| Age: 45 Female | $97 | $92 |

| Age: 45 Male | $103 | $96 |

| Age: 60 Female | $87 | $78 |

| Age: 60 Male | $91 | $81 |

Females generally pay less than males, while younger applicants face higher costs. These figures highlight cost variations based on insurers and demographics.

Life Insurance Monthly Rates: Term vs. Whole| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $18 | $250 | |

| $25 | $285 |

| $27 | $295 | |

| $23 | $275 |

| $20 | $260 | |

| $24 | $280 |

| $26 | $290 |

| $22 | $270 |

| $21 | $265 | |

| $19 | $255 |

The table compares AIG vs. Nationwide life insurance rates for term and whole policies. Read more in our article titled, “AIG American General Life Insurance Company Review.”

It highlights how pricing varies by provider and coverage type. AIG’s term life insurance rates start at $18, while Nationwide begins at $20.

AIG vs. Nationwide Life Insurance Coverage Plans

This table breaks down how AIG and Nationwide handle eight key life insurance types. Term Life offers fixed protection for a set period and is available from both.

AIG vs. Nationwide Life Insurance Coverage Options| Coverage Type | ||

|---|---|---|

| Term Life Insurance | ✅ | ✅ |

| Whole Life Insurance | ✅ | ✅ |

| Universal Life Insurance | ✅ | ✅ |

| Indexed Universal Life | ✅ | ✅ |

| Variable Universal Life | ✅ | ✅ |

| Final Expense Insurance | ✅ | ✅ |

| Guaranteed Issue Life | ✅ | ❌ |

| Survivorship Life | ✅ | ✅ |

Whole Life builds guaranteed cash value with level premiums. Universal policies allow adjustable payments and death benefits. Indexed and Variable Universal Life tie growth to markets; AIG emphasizes broader fund access, while Nationwide prioritizes index-based gains.

Only AIG includes guaranteed issue life insurance, ideal for those with health concerns. See why universal life insurance with a return on premium is a smart choice.

Final Expense covers burial costs and is available from both. Guaranteed Issue is offered only by AIG and requires no medical exam. Survivorship Life, present with both, insures two people under one policy and is often used in estate planning.

AIG vs. Nationwide Consumer Complaints and Feedback

This table compares AIG vs. Nationwide life insurance based on consumer satisfaction and business ratings. Nationwide scores higher in J.D. Power rankings and customer feedback.

Life Insurance Business Ratings & Consumer Reviews: AIG vs. Nationwide| Agency | ||

|---|---|---|

| Score: 835 / 1,000 Avg. Satisfaction | Score: 728 / 1,000 Above Avg. Satisfaction |

|

| Score: A Good Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 77/100 Good Customer Feedback | Score: 75/100 Positive Customer Feedback |

|

| Score: 0.98 Fewer Complaints Than Avg. | Score: 0.78 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A Excellent Financial Strength |

Both companies hold strong A.M. Best ratings. Complaint ratios indicate Nationwide receives fewer complaints than AIG, reflecting stronger overall consumer trust.

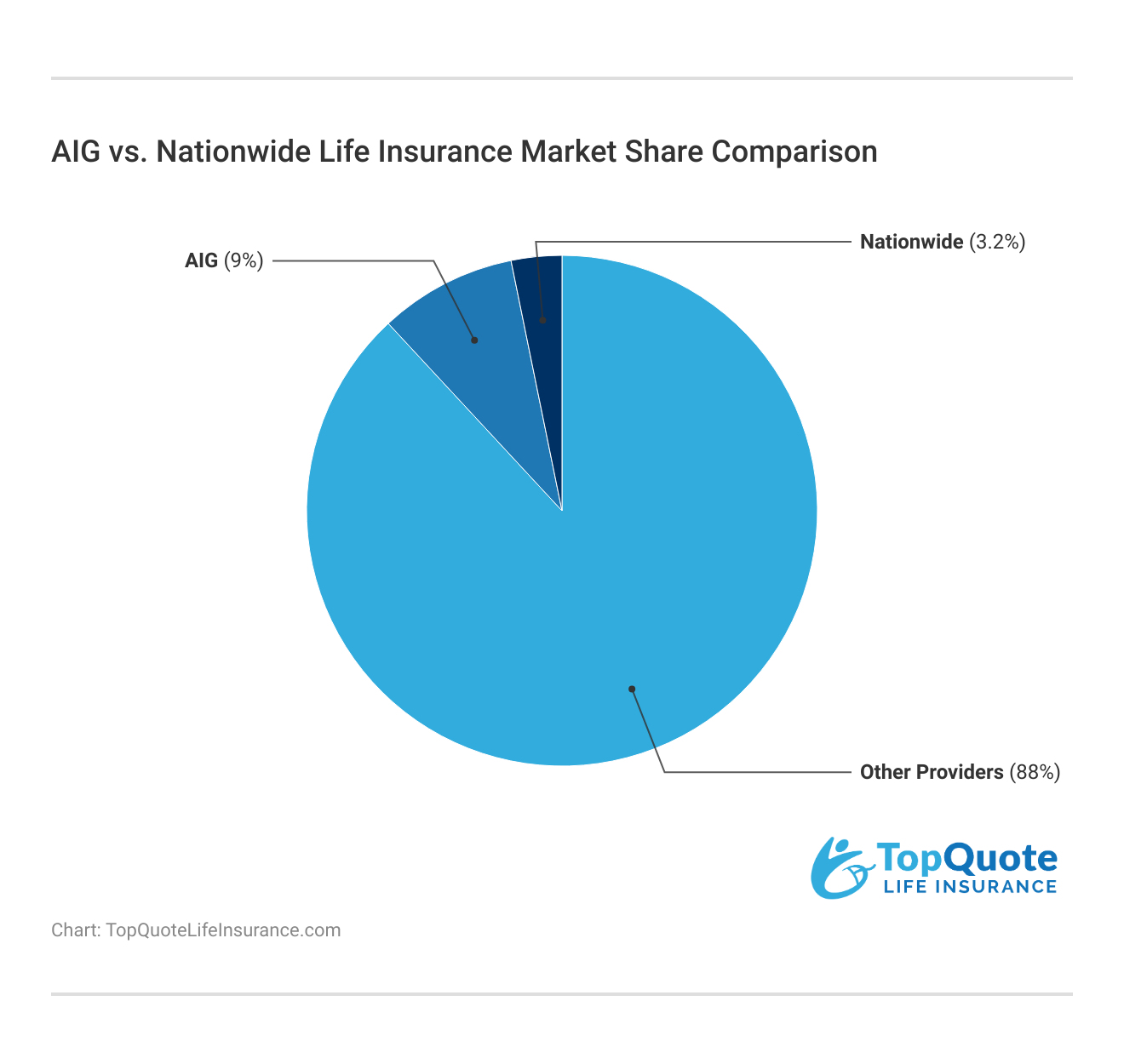

The table above compares the market share of AIG and Nationwide among other providers. AIG holds 9% of the market, while Nationwide accounts for 3.2%. The remaining 88% is distributed among other insurers.

A Reddit post notes Nationwide’s A+ A.M. Best rating and strong claim-paying ability. It compares its brand to top insurers and suggests reviewing customer experiences.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

AIG vs. Nationwide Life Insurance: How They Compare in Reviews

We’ll close this guide by analyzing AIG and Nationwide insurance reviews from the Better Business Bureau (BBB) and A.M. Best. A positive rating from one or both of these organizations can give potential insured confidence in a life insurance provider’s financial stability and commitment to customer service.

The BBB scale ranges from “A+” to “F.” AIG insurance rating received the lowest grade of “F” and also lacks accreditation. Did Nationwide do any better with the BBB? Yes; not only does it hold accreditation but it also has the highest rating of “A+.”

Discover more by reading our guide: Best Types of Life Insurance Policies Reviewed

A.M. Best’s Financial Strength Rating (FSR) scale is slightly different in that it ranges from “A++” down to “D.” AIG life insurance rating from A.M. Best is “A.” How did Nationwide do? It received a rating one notch higher than “A.” In review, Nationwide won every single category of our comparison.

Affordability and flexibility set these insurers apart in key ways. For example, Nationwide provides lower rates for older applicants, while AIG offers more term choices.

Jeff Root Licensed Insurance Agent

Don’t let your life insurance comparison stop with AIG vs. Nationwide. Type your ZIP code into our free and helpful tool below to see quotes from multiple companies in your area.

Frequently Asked Questions

How strong is the AIG term life insurance rating?

The AIG term life insurance rating is strong, with an A rating from A.M. Best, reflecting financial stability and a reliable ability to pay claims. See why Term Life Insurance vs. Whole Life Insurance offers unique advantages based on your goals.

How can you get a Nationwide insurance quote?

You can get a Nationwide insurance quote online by entering basic details about your coverage needs or by speaking with an agent for personalized options.

What do AIG term life insurance reviews say about its policies?

AIG term life insurance reviews highlight competitive monthly rates and flexible coverage options, though some customers report mixed experiences with claims processing. See how AIG vs Nationwide compare in rates and coverage by entering your ZIP code.

Which providers are included in the top 100 life insurance companies in the USA?

The top 100 life insurance companies in the USA include a wide range of insurers, including well-known providers like AIG, Nationwide, and Prudential. These companies are ranked based on market share, financial strength, and customer satisfaction.

What makes Protective Life insurance a strong choice?

Protective Life insurance company offers term, whole, and universal policies with competitive monthly rates. It is known for flexible coverage options and strong financial ratings, making it a reliable choice for long-term security.

Who are the top 20 life insurance companies in the USA?

The top 20 life insurance companies in the USA include leading providers like AIG, Nationwide, and Prudential. They are ranked based on financial strength, customer satisfaction, and policy offerings.

Which insurers are ranked in the top 10 life insurance companies in the USA?

The top 10 life insurance companies in the USA include major providers like State Farm, New York Life, and Northwestern Mutual. These companies are known for their strong financial ratings, diverse policies, and high customer satisfaction.

What coverage options does AIG life insurance offer?

AIG life insurance provides term, whole, and universal life policies, including guaranteed issue life insurance for individuals with medical concerns. It also offers flexible riders for added protection.

Where can you find Protective Life insurance reviews on Reddit?

You can find Protective Life insurance reviews on Reddit in finance and insurance forums, where users discuss policy experiences, claims processes, and customer service insights from real policyholders. Discover simple tips when choosing the best life insurance provider wisely.

Which providers rank among the largest life insurance companies in the world?

The largest life insurance companies in the world include MetLife, China Life Insurance, and Prudential Financial, recognized for their global presence, high revenue, and extensive policy offerings.

What do AIG life insurance reviews say about its policies?

AIG life insurance reviews highlight its flexible policy options, strong financial ratings, and guaranteed issue plans, though some users report mixed experiences with claims processing and customer service.

How do Liberty Mutual vs Nationwide compare in life insurance options?

Liberty Mutual and Nationwide both offer term, whole, and universal life insurance, but Nationwide provides a No-Exam Life Insurance program, while Liberty Mutual focuses on customizable term policies.

Which company provides better life insurance, American Family vs Nationwide?

American Family vs. Nationwide life insurance differs in policy flexibility. Nationwide offers indexed universal life options, while American Family life insurance focuses on term and whole-life coverage with additional riders.

What are the differences between USAA vs Nationwide life insurance?

USAA vs Nationwide life insurance mainly differs in eligibility, as USAA caters to military families, while Nationwide provides broader access with a No-Exam Life Insurance program for faster approval.

How does Nationwide vs The General compare in life insurance offerings?

Nationwide vs. The General differs significantly. The General focuses on auto insurance, while Nationwide offers a range of life insurance products, including term, whole, and universal policies. Use our free quote tool to find out how AIG and Nationwide policies differ.

Which provider offers more life insurance options, Farmers vs Nationwide?

Farmers vs Nationwide life insurance policies include term and whole options, but Nationwide also provides indexed universal life coverage and long-term care riders for added flexibility.

How do AIG vs Pacific Life differ in life insurance coverage?

AIG vs. Pacific Life life insurance differs in policy variety. AIG offers guaranteed-issue whole-life policies, while Pacific Life specializes in indexed and variable universal life options. Explore what is the best life insurance coverage for financial protection.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.